17

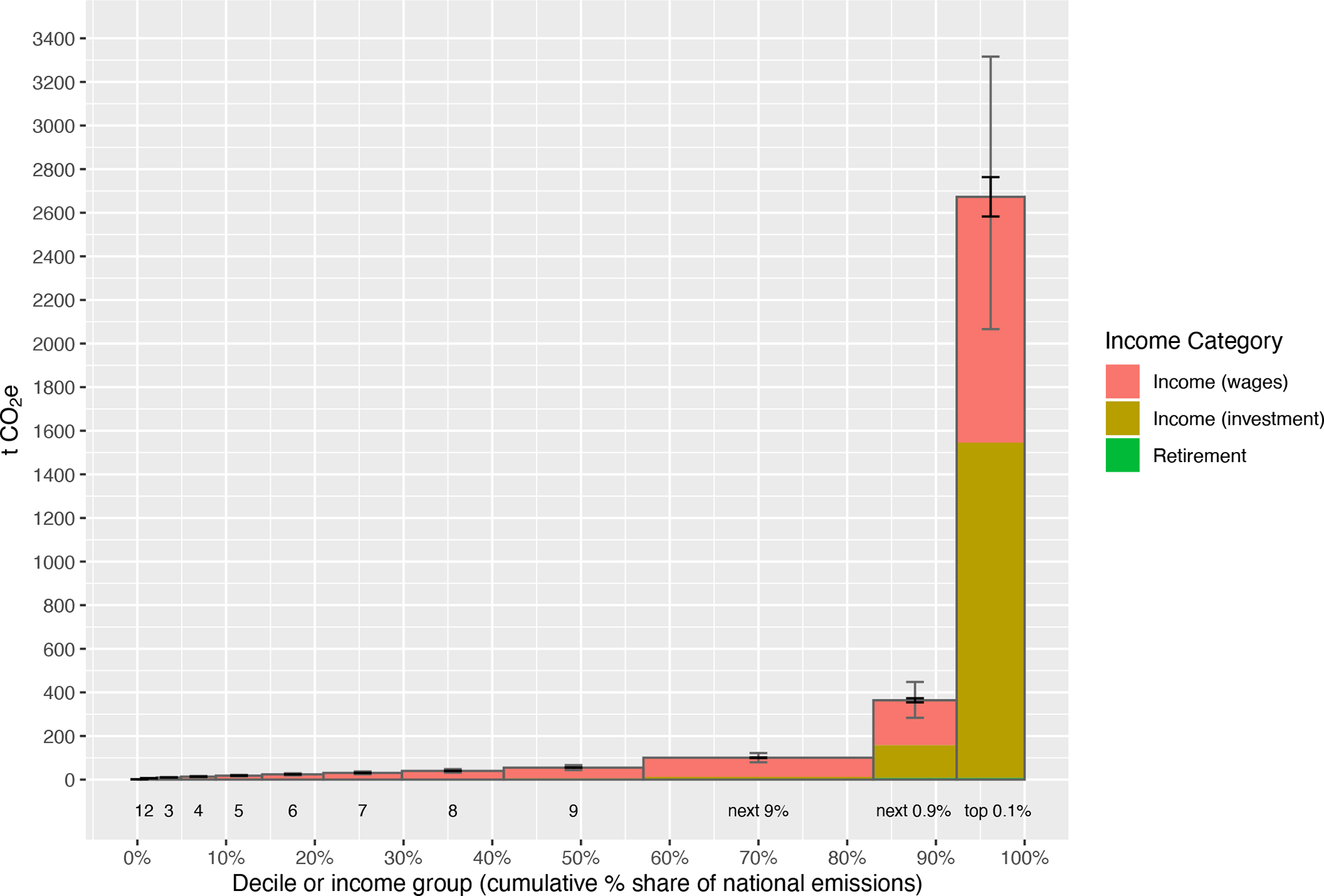

Current policies to reduce greenhouse gas (GHG) emissions and increase adaptation and mitigation funding are insufficient to limit global temperature rise to 1.5°C. It is clear that further action is needed to avoid the worst impacts of climate change and achieve a just climate future. Here, we offer a new perspective on emissions responsibility and climate finance by conducting an environmentally extended input output analysis that links 30 years (1990–2019) of United States (U.S.) household-level income data to the emissions generated in creating that income. To do this we draw on over 2.8 billion inter-sectoral transfers from the Eora MRIO database to calculate both supplier- and producer-based GHG emissions intensities and connect these with detailed income and demographic data for over 5 million U.S. individuals in the IPUMS Current Population Survey. We find significant and growing emissions inequality that cuts across economic and racial lines. In 2019, fully 40% of total U.S. emissions were associated with income flows to the highest earning 10% of households. Among the highest earning 1% of households (whose income is linked to 15–17% of national emissions) investment holdings account for 38–43% of their emissions. Even when allowing for a considerable range of investment strategies, passive income accruing to this group is a major factor shaping the U.S. emissions distribution. Results suggest an alternative income or shareholder-based carbon tax, focused on investments, may have equity advantages over traditional consumer-facing cap-and-trade or carbon tax options and be a useful policy tool to encourage decarbonization while raising revenue for climate finance.

You must log in or register to comment.