- cross-posted to:

- usa@midwest.social

- usa@lemmy.ml

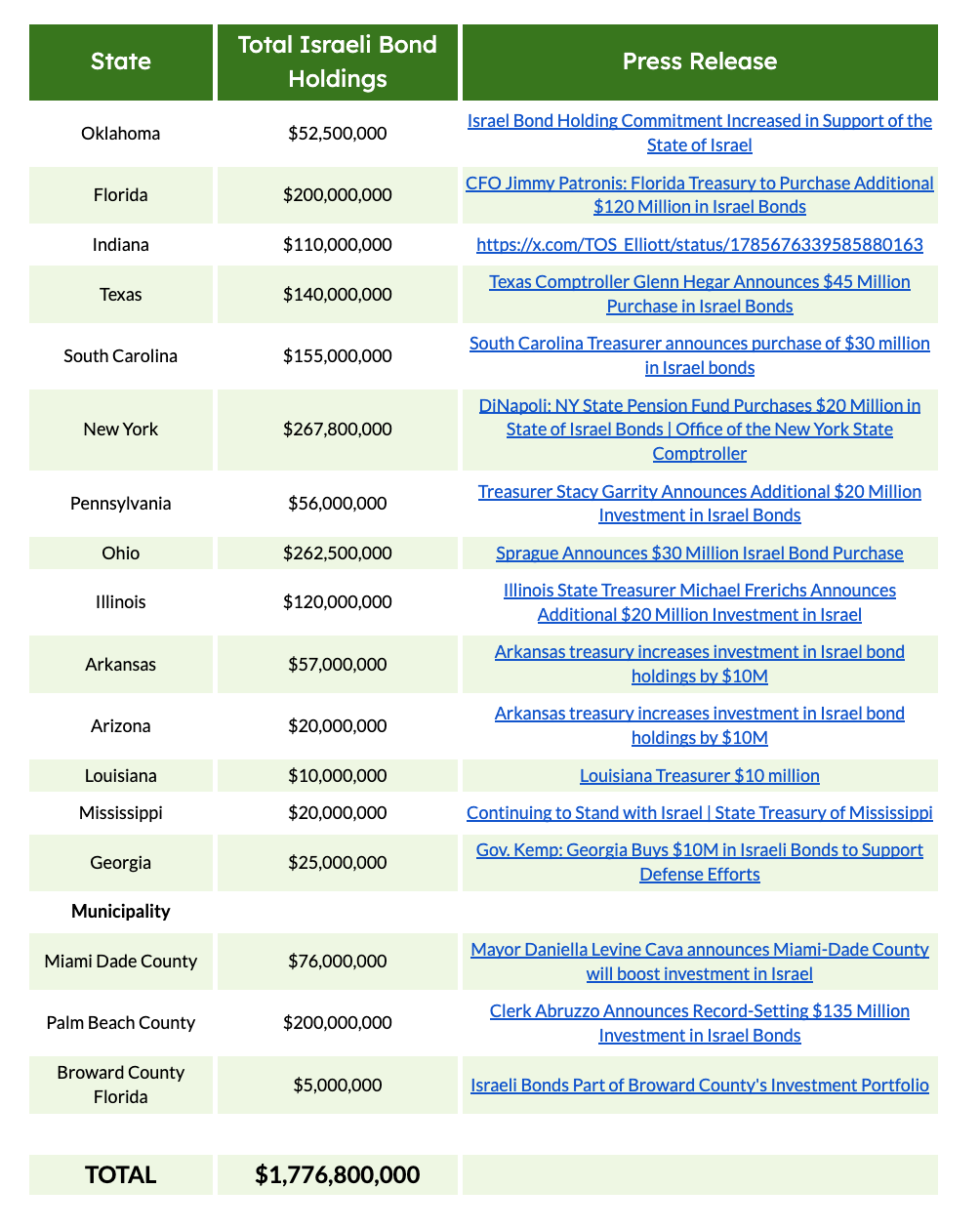

Since 2020, states and municipalities across the country have amassed a portfolio of $1.7 billion in "Israel" Bonds—securities sold by the "state" of "Israel" to “strengthen every aspect of "Israel's" economy, enabling national infrastructure development.” Since October 7th, 2023, $580 million of state and municipal investments have been invested in "Israeli" bonds.

In some cases, the state treasurers and comptrollers that purchased "Israeli" bonds are the very same officials who pushed for laws in their states against investing in firms that embrace environmental social governance (ESG), or investments based, at least superficially, on diversity, climate change, or any other criteria they deem “woke.” Their argument: If a firm makes politically motivated investment decisions in accordance with ESG, then the firm has compromised its fiduciary duty to be a good steward of dollars and maximize returns for investors.

Were the "Israel" Bonds a secure investment, with growth fueled by regional war? No. In fact, they are rapidly losing value, earning a 20% lower return than when they were initially purchased just one year ago.

And it’s only going to get worse. Both S&P and Moody’s lowered "Israel’s" credit rating twice this year. Last October, "Israel" Bonds had a fixed rate of 5.74 to 5.96%, according to releases by state treasurers’ offices. The current rate for those same 3-year bonds now falls between 4.38-4.6%.

Yet many of the state treasurers and comptrollers across the U.S. who bought the bonds are unfazed. They invested not for the high returns, but, as Palm Beach County Clerk Joseph Abruzzo put it, because "Israel" is “our greatest ally” and “needs this money.”

imagining a timeline where "Israel" defaults on these bonds and it sends multiple US states into bankruptcy