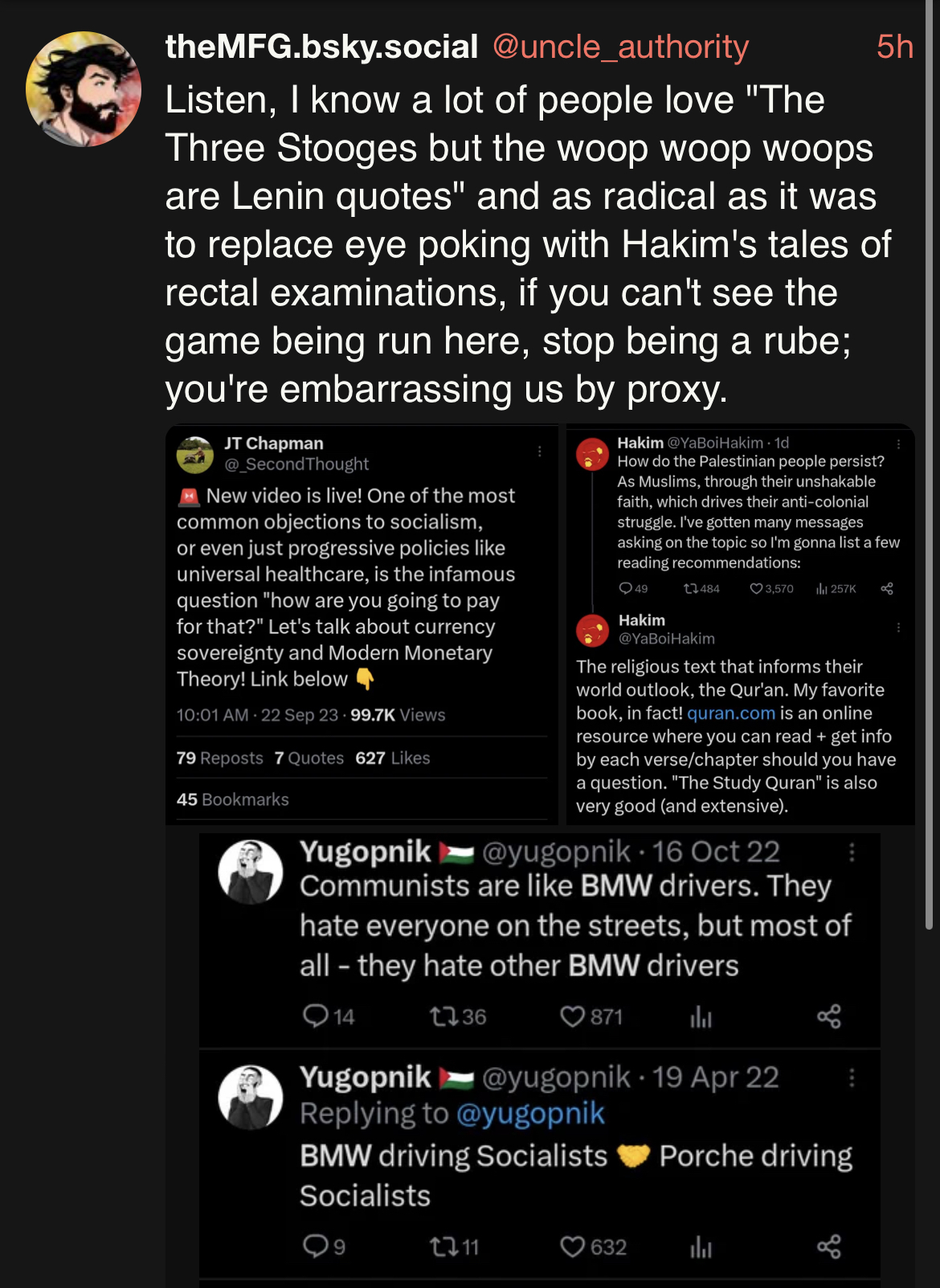

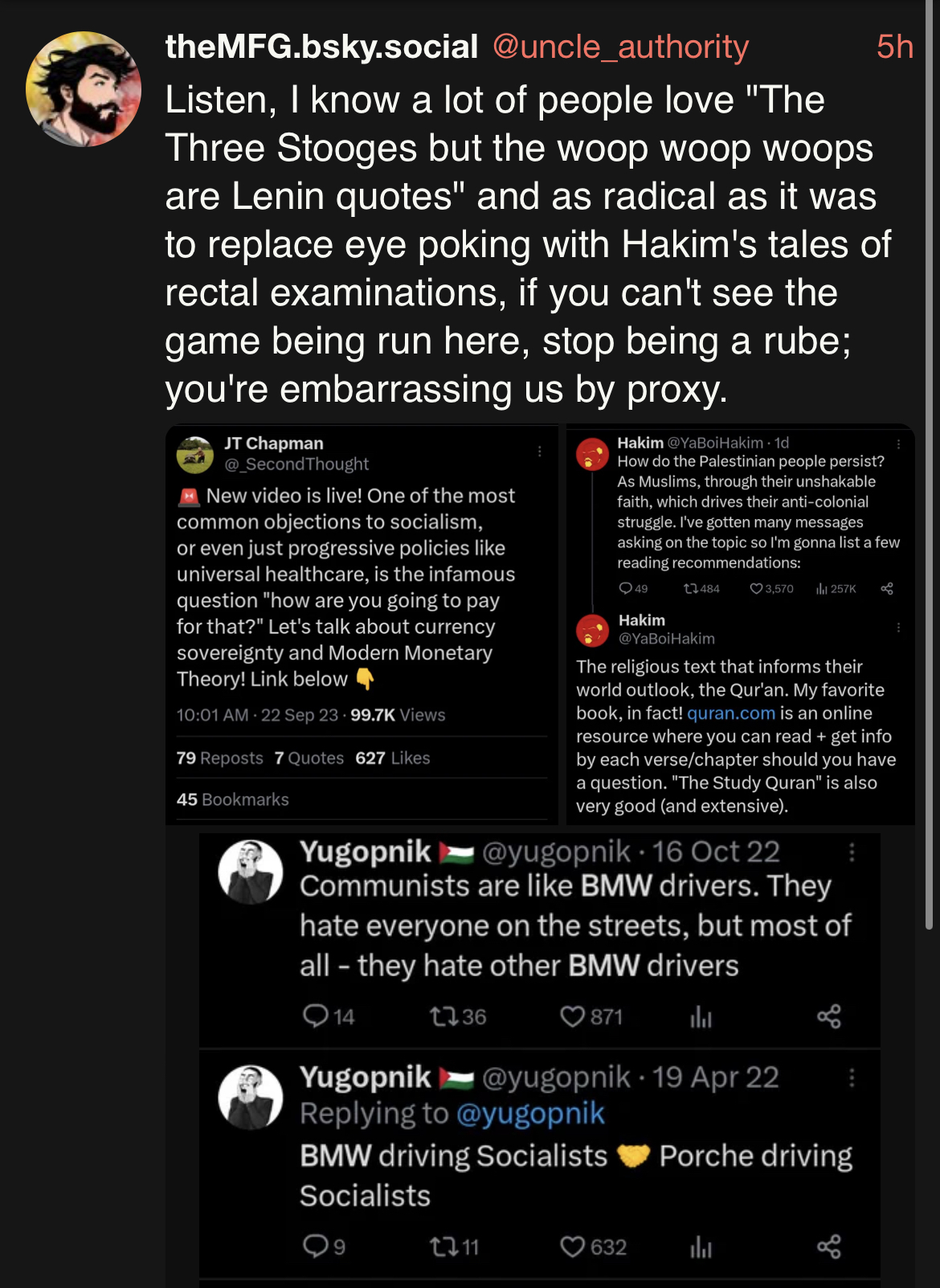

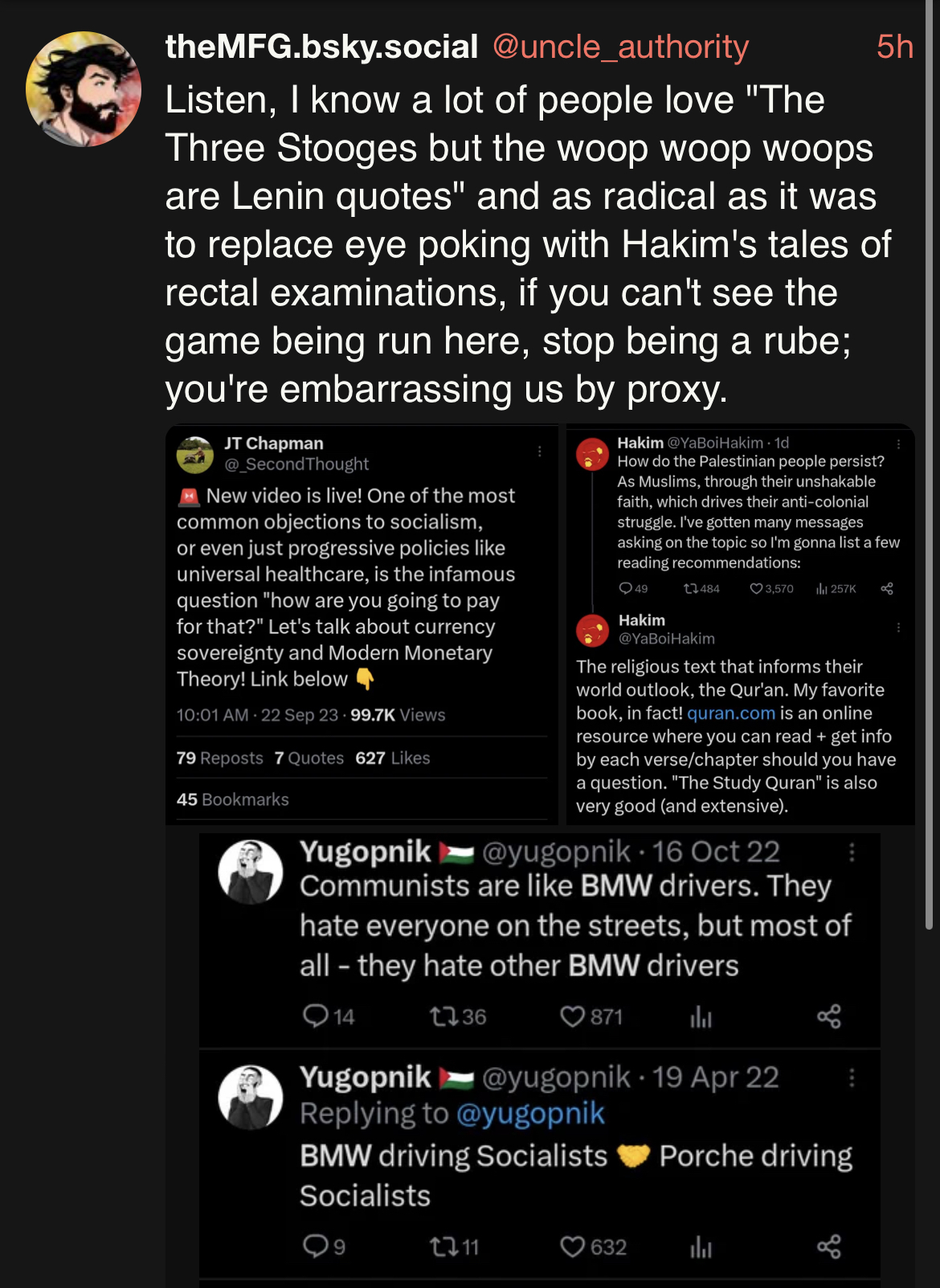

Dude’s an ultra

Bonus: https://nitter.net/uncle_authority/status/1721967810241335347#m

I guess the Deprogram guys are the Three Stooges now? But the joke doesn’t really work

Show

Dude’s an ultra

Bonus: https://nitter.net/uncle_authority/status/1721967810241335347#m

I guess the Deprogram guys are the Three Stooges now? But the joke doesn’t really work

I really doubt that MMT could be applied to post-NEP USSR, because its economy functioned on radically different principles than capitalist economies.

MMT has little to do with whether it is a capitalist or a socialist economy, it is simply a description of how fiat money works.

MMT: the ability of a government with currency sovereignty (not pegged to gold or other currency) to deficit spend is not bound by the taxes it collects

After WWI, many countries re-pegged to the gold standard and eventually walked into the Great Depression in 1929-33 as their fiscal space was limited by the amount of gold reserves they possessed.

In the USSR, there was a brief period of toying with returning to the gold standard during the NEP (golden chernovets), but as Solonikov (People’s Commissar of Finance) was expelled in 1926 after joining Kamenev and Zinoviev’s “new opposition”, the issuance of chernovets stopped, and ruble was decoupled from the gold standard.

Fig. 1. Average monthly volume of ruble in circulation in the USSR (in trillion). Source: Central Bank of Russia

Look at how the money supply shot up exponentially as the USSR entered the first Five-Year Plan in 1929 to finance public infrastructure projects at a scale never seen before. There is no way that they could have created so much money if they were to adhere to the gold standard.

Meanwhile, Soviet citizens paid very little taxes while getting free housing, education, healthcare and public services. The USSR recovered to its pre-war economy in just 5 years, while keeping pension and social services intact, after half of the country was laid in ruins and 27 million Soviet people perished during Nazi Germany’s invasion. There is no way they could have done that while keeping to the neoclassical (monetarist) theory, after experiencing such economic devastation.

According to MMT, a government with monetary sovereignty can spend as much as it wants and is only limited by labor, resources and technology.

Stalin at the Plenum of the Central Committee of the All-Union Communist Party of Bolsheviks, 1933:

(Note: the US eventually also went off gold in 1933 during the New Deal, re-pegged to gold during the Bretton Woods from 1944 until Nixon’s decoupling in 1971)

Good poast hot damn

The reason citizens paid little tax was because the government got most of its funding from SOE profit. It has nothing to do with MMT.

This makes no sense under fiat monetary sovereignty. The government never makes a “profit” or a “loss” in any meaningful way (in its own currency).

It would be closer to the truth to see it as the government 1) never having any money at all, and 2) having the power to distribute to others arbitrarily large amounts of money and 3) having the power to destroy arbitrarily large amounts of that distributed money through taxation.