How is it financial independence when you rely on a bunch of people who can barely scrap by to pay you

AND milk them so much they turn to tax-funded services.

Even by a libertarian standpoint, fuck landlords because their greed is stopping them from getting a tax cut.

The only people who have any room to talk about financial or economic “independence” are people who grow their own food.

https://www.smithsonianmag.com/smart-news/heres-what-happened-people-who-were-executed-having-molten-gold-poured-down-their-throat-180951695/

I fucking love science :CommiePOGGERS:

financial independence is when you depend on other people's salaries

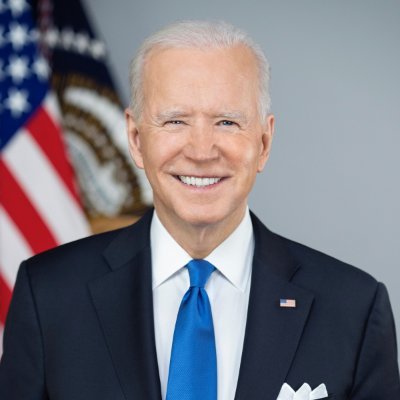

Why do landlords and right-wing ghouls all have the same dead look in their eyes?

they don't believe in the lived human reality of anyone but themselves, and are therefore dead

I mean I'd be fucking exhausted just from the amount of paper work involved with this many properties

Dude's got at least $20,000,000 in assets just in the houses, and probably pulls in $200,000+ per month on rents. I guarantee you he does none of that work himself. The cold, dead look in his eyes is from having very definitely killed people by parasitizing their labour.

The only person I know who is "financial independent" is because of his labor selling. He has worked for ~15 years in video editing/production as his "side-hustle"/Freelancer while working at a MEGACORP on the 9-5 like most people.

He hasn't done any fancy financial/banking schemes just regular saving. Doesn't live like a king but he gets to put in minimal effort into his 9-5 cause of his freelancing. I would imagine it's also because of the time he was doing was in the early 2000's and 2010's before the proliferation of lot of software that makes it a lot easier these days.

He gets to live his late 40's doing what he likes to do and working on projects he likes without having to count his chips. He doesn't have a "passive income" (if anything has a very "active income") he just has enough squared away that he doesn't really have to sweat bills anymore so long as he doesn't do anything too crazy. That's ideally how I'd like my future to be. Just having enough to do what I want and not have to do the 9-5.

:mao-aggro-shining: LANDLORD DETECTED :mao-aggro-shining:

Maybe he shouldn't be required to do stuff like this to be financially secure in the first place.

you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house and then you rent that house to pay off the last loan you took out to buy a home so you take out a loan and buy a house then you rent that house to pay off the last loan you took out to buy a home so

Except you don't pay off the loan you just make payments on them

Oh wait that's the bit I'm an idiot

This fucking guy is definitely leveraged up to eyeballs and I bet even a shortterm hiccup in his wealth extraction factory would domino across his entire portfolio and he'd lose everything. That is why laws must be put into place to never allow his reckless investments to fail.