https://www.marketwatch.com/livecoverage/stock-market-today-dow-futures-flat-after-1000-point-rally-in-four-days/card/a-reliable-labor-market-recession-indicator-has-triggered-but-this-time-it-could-be-bullish-for-stocks-sXgJRUlCo2TNywR6XgDc

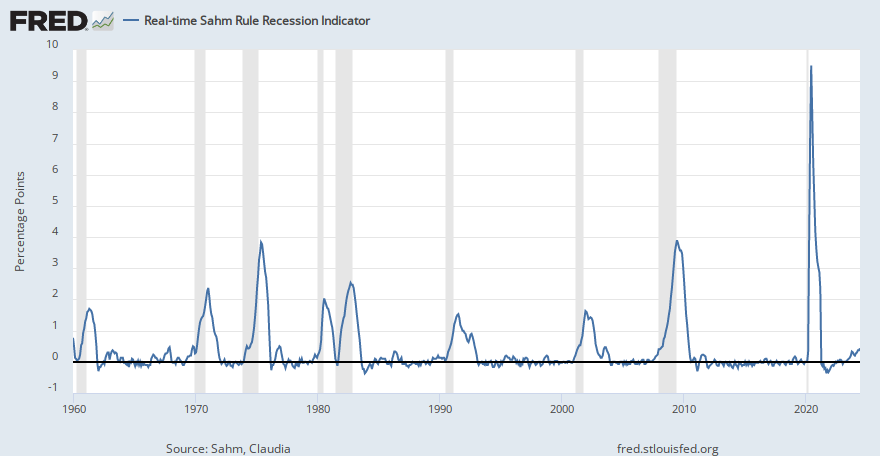

The Sahm rule is a robust tool that has been very accurate in identifying a downturn in the business cycle and almost always doesn't trigger outside of a recession. The simplicity of the calculation contributes to its reliability. The Sahm rule signals the early stages (onset) of a recession and generated only two false positive recession alerts since the year 1959 (there have been 11 recessions since 1950); in both instances — in 1959 and 1969 — it was just a little untimely, with the recession warning appearing a few months before a slide in the U.S. economy began.[13] In the case of the false positive warning related to the year 1959 it was followed by an actual recession six months later. The Sahm rule typically signals a recession before GDP data makes it clear.

https://en.m.wikipedia.org/wiki/Sahm_rule

And then they didn't. (Joe Biden still owes me $2000.)

She seems cool though, for an economist at least:

"I created the Sahm rule to send out stimulus checks automatically. The idea was to act fast to make the recession less severe and help families. The star was always the stimulus check, not the indicator that other people named after me."