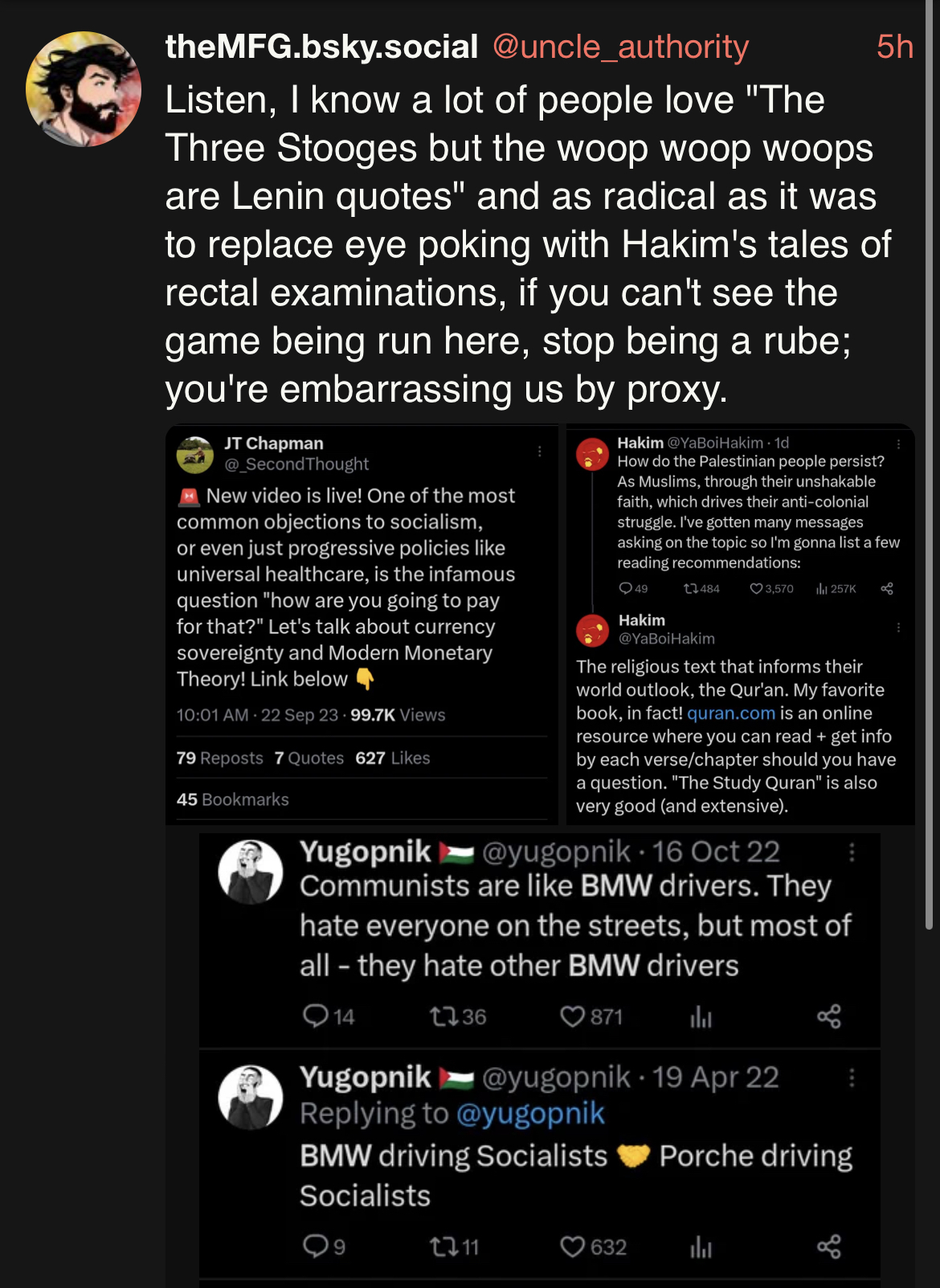

Dude’s an ultra

Bonus: https://nitter.net/uncle_authority/status/1721967810241335347#m

I guess the Deprogram guys are the Three Stooges now? But the joke doesn’t really work

Show

Dude’s an ultra

Bonus: https://nitter.net/uncle_authority/status/1721967810241335347#m

I guess the Deprogram guys are the Three Stooges now? But the joke doesn’t really work

MMT gibberish to me

MMT is:

that's basically it, idk what people get so worked up about.

to this I would add tax liability under sovereign currency creates demand for the currency that otherwise has low value (socially necessary labor time required to produce). this is the part goldbugs don't understand. Of course the dollar inflates. Because it's backed by bourgeois state coercion violence rather than by the value of some metal coming from a mine.

That's a remarkably succinct and elegant summary. The only thing I can think to add is that taxes can also be a punitive measure to discourage certain behaviors i.e. nicotine tax

Makes a lot of sense. One interview I saw with Michael Hudson he seemed to say that government spending domestically doesn't cause inflation, but he didn't really have a chance to elaborate so I'm not sure what that meant. Something like, balance of payments is more important, for example I think he said the Weimar Republic experiencing hyperinflation was because all the money they printed went toward exchanging for foreign currencies to pay war reparations etc which drove down the value of their currency, but if they had just been printing money for domestic spending it wouldn't have caused such inflation. Idk if anybody here could clear that up for me. Intuitively, it seems like more government spending would increase the money supply and therefore be inflationary, but does anybody know what Dr Hudson was getting at?

MMT has always asserted that inflation risk is only a problem when you have full employment and resource utilization has been maxed out. That increasing money supply leads to inflation is a monetarist (neoclassical) myth, with little empirical evidence to support.

The problem with most countries that follow neoclassical economic theory (which is pretty much every country today) is that they spend too little, and when the government does not spend, there is not enough money to go around, people will have to borrow/take out loans from private creditors, which benefit the bankers/finance capitalists.

Hudson is right that hyperinflation almost always occur because of foreign debt, and in the case of Weimar Republic it was because of the forced reparation by the Allies (who were in turn forced by the US to repay the debt financing the war effort). This was detailed in his book Super Imperialism.

Yeah I'm working through reading Super Imperialism right now actually, I read the first few chapters but got distracted by something else a while back, I'll probably have to start over. So I got to the part about the system of circular payments between Germany, the Allies, and the US. Thanks for explaining more about what MMT says on inflation.

So basically, in the US for example, the government could afford to spend a lot more domestically without risking inflation because employment isn't maxed out and there's a lot of productive things the money could be spent on to improve the economy, so you don't end up with "more money chasing the same amount of goods" as the traditional (neoclassical) wisdom goes? That also makes sense to me.

I think Hudson goes on to describe how a huge amount of US dollars flow out of the country through both the trade deficit and US government (military mostly) spending abroad, end up in the hands of foreign central banks who can't do much with them other than buy US Treasury bills and that this new circular flow of money (with the US as debtor this time instead of creditor like the post WW1 era) forms the basis of US dominance over the world financial market. But I'm not sure how this part interacts with the basic MMT ideas above. Would Hudson say, basically, that the US could/should be spending its money domestically in the way that MMT says it can instead of doing Super Imperialism by flooding dollars out to the world?

TL;DR: Dollar hegemony has nothing to do with the ability of US government to spend domestically. It simply allows the US imperialist to get free lunches from across the world. But they’re two separate issues.

A lot of people get confused by this. But it’s two separate issues:

First, it’s not so much about spending domestically, but the fact that the neoliberal government refuses to deficit spend and instead chooses to adhere to austerity (spending not too much than than what you “earn”). It treats government spending as if you would treat your own household spending, which is nonsense because the government is the currency issuer (it literally is the one that creates the money), whereas as individual households you do not have that power.

What this entails is that since the government is not spending (government spending = private sector saving), there is not enough net new asset that flows into the pockets of the citizens (private sector), and to fuel the economy the private sector (businesses, consumers) has to take on loans from private financial institutions. This results in the rise of debt owed to private creditors, where the profit and earnings of private businesses and citizens now flow into the banking sector.

What MMT is prescribing is simply that government spend as much as it wants without even looking at how much it “earns” (taxes), and this is typically done by some kind of large scale infrastructure building program. This public spending creates jobs (new hospitals and schools need to be built, more demands for goods and services, more suppliers are needed etc.), improve the wages and living standards (less reliant on taking loans from banks, while new hospitals and schools reshape the surrounding environment that improves the quality of living etc.)

Even if inflation happens, so what? If wages are increasing faster than inflation, what’s there to worry about? This was what happened during the War Economy in the United States during WWII - full employment, all industries repurposed for the war effort - and brought the country out of the Great Depression in just a few years.

——

Now, on to the second part, which is how dollar hegemony relates to all we have just said? Actually, not much at all. It doesn’t affect the US government’s ability to spend domestically.

It is important to note that, in this context, dollar hegemony simply means that the US can get “free lunches” from all across the world by printing dollars out of thin air. Because every country needs dollar (because they owed debt in dollar, or because they need to import essential goods priced in dollar, because it is a reserve currency that is accepted by everyone relative to other currencies etc.), so long as they are willing to export their goods and services to America to receive dollar, the US can simply print as much dollar as needed to pay for them (i.e. essentially for free).

These exporters, upon receiving the dollar and after using a portion of them to import American goods (or other goods sold in dollar), will have to keep their surplus dollar somewhere. Since they are not allowed to purchase critical American industries, their best bet is to buy US treasuries to earn interests. As such, the surplus dollars are recycled back to the US treasuries, which in turn allows the US to spend even more dollars overseas (to build military bases surrounding their countries, for example) since the surplus has already been absorbed back into the US treasury.

In other words, the US treasury acts as a vehicle to absorb the imbalance in the balance of payment caused by America printing money out of thin air to get free lunches from overseas.

——

That’s it - it’s the mainstream narrative that is confusing a lot of people: America borrows from China! We are debt slaves to China! If China wants us to repay our trillion dollar debt (actually down to $800 billion now), then our country will go bankrupt!

Actually, it’s more like this: China is a net exporter to America - China receives payment in dollar - China stores the surplus dollar in US treasury (“lending to the US government”) - Chinese holding of treasury bonds mature - time for US government to pay up! - Federal Reserve credits the exact amount of money (created out of thin air) back to China’s account in the Federal Reserve plus interests - China again not knowing what to do with the dollars - China buys more US treasuries with the money they just got back - rinse and repeat.

As you can see, none of this impacts the US government’s ability to spend domestically, like giving free healthcare to everyone.

Great explanation, that really helped some things click for me. Thank you!

deleted by creator

This is completely wrong, both empirically and theoretically and shows the liberal ideology deeply embedded in MMT theory.

The stuff above is largely correct but better stated in the Marxist way. There are two kinds of government appropriation, real and symbolic. Real appropriation is spending, the government ordering people to do something, build a road, teach some students, etc. Symbolic appropriation is taxation, it doesn't actually matter that the government takes some bits of paper (or gold), but it justifies the real appropriation and sort of determines how the burden of government action is distributed.

None of this is to say that getting rid of taxation is a good idea, indeed, it is impossible to get rid of government appropriation without getting rid of government entirely. It is worse to have a hidden appropriation that has distorting effects as in the case of the Soviet Union and better to have transparent taxation which doesn't punish certain kinds of enterprises (namely the state owned ones, by requiring them to fund the whole government).