I read not long ago that like a third of houses purchased in the US today are never occupied by the purchasing entity. That's an insane number.

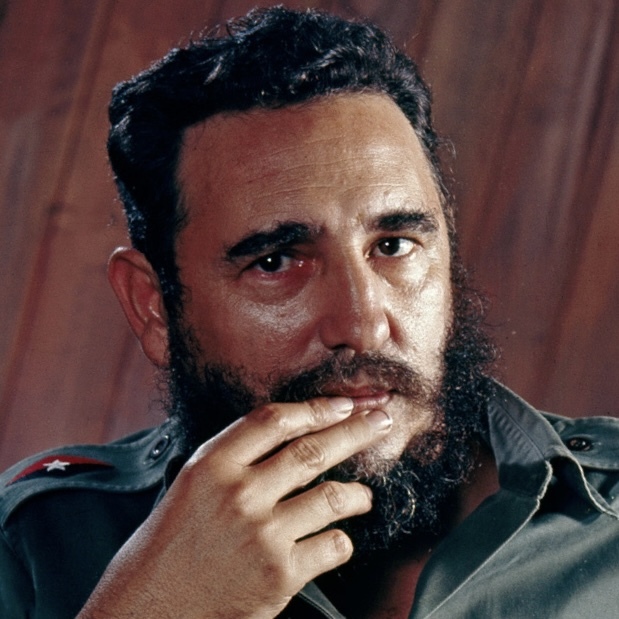

:mao-aggro-shining:

I get why it’s hard for people who have kids, but I’ve never once not felt like I was living the dream and extremely privileged to be able to work from home now.

The average housing budget for out-of-towners moving to Nashville was $720K, ~50% higher than locals’ $485K budget. It used to be coastal elites who worried that every adult in the family had to win a career lottery, just to afford a home. Now that feeling may spread.

That is fucking horrifying.

fully expect to never afford a house in my life. maybe one day I'll just take one over with the comrades but I'll never afford one.

People are buying houses in my city for 10-20% over the asking price in cash. Average cost of a home is now around $450k but minimum wage is still $7.25 an hour. I can only wonder how long it can last like this. I’ll probably never own a home at this rate.

Most millennials and younger will be renting until they die unless there's a revolution.

Where are these people getting hundreds of thousands of dollars in cash? Seriously, I can't figure it out, that's a fuck ton.

Cryptocurrency speculation, selling their California house, $550k total compensation at FAANG companies, rich parents. Or worse from landlording or real estate speculation

my neighbor's business made a bunch of money off everything going online (they do software development or something) and for the past year they have been buying tons of houses and renting them outand I think make more money leaching off their tenants now :agony-shivering:

Best country on earth. The city I live in is marked by high costs due to retirees owning a couple investment properties and then having one of a few management monoliths actually service it.

It seems to be a lot of investment and real estate companies in my cities. There are private individuals from higher cost of living areas that have cash from their previous homes too.

I was going through the process of applying for a home loan to put in a bid months ago and asked my loan officer about this ("is this real in our area?"), and they said "we have definitely heard about organizations making all cash offers well over asking to secure a home quickly since that means the bidder doesn't have to wait the weeks it takes for traditional financing"

I have seen financial news articles that say a lot of "institutional investors" (I.e. index funds and pensions etc) are increasing their involvement in residential housing investment through rental companies.

the comments were full of middle class types realizing it was probably their own retirement account making it harder for them to own a home and that, if there is a housing market collapse, it will fuck homeowners from selling their home to retire and tank their retirement plans.

Oh of course. This must be all the competition I've heard about that makes the market work. :mao-aggro-shining:

People are moving away from big, expensive cities to places with lower cost of living (particularly wrt housing) because they're able to do so and still telecommute. So costs seem to be falling in places like LA, SF, and NYC.

For low-tax states, 4 people move in for every 1 who leaves. For Texas, this ratio is 5:1; for Florida, 7:1.

I'm sure there's no problems with people flocking to hot, coastal states the way that the climate is going

My new pet theory, just based entirely on anecdotal evidence around me... a lot of people are buying houses first and then figuring out how to pay for it later. And low down payments make this even more possible. Like, they technically have the income to pay for it now but they're gonna realize quick how little financial flexibility they have, and any shocks like losing a job or health expenses will make it so they can't make that mortgage payment anymore. No savings, just plowing it all into a mortgage payment.

Also wondering if the housing market is one of the first signs that were gonna start seeing some massive inflation.

Its 100% small time landlords buying a 2nd or 3rd property as well as enormous hedge funds or Blackstone et al that are buying up properties. Probably more the latter, but the former is why it's happening in podunk nowhere as well.

If housing is an investment or profit machine, you can afford tighter margins on rent to mortgage because your plan is to own and rent for the next 50 to 100 years. So who cares if it costs 2 times over asking? You'll make it back 30 years later and then make pure profit for another 30. Plus, rates are historically cheap and the fed has shown 0 capability of raising rates to higher than 5% or so (prior to 2008 it was usually near 10%).

Someone needs to form a leftist fund to buy land and build communes. I would love to live in a commune.

Id step down from the idea of a "commune" since it's a bit too idealistic and everyone needs to be 100% in and even the there's drama. There are already existing self-sustenance communes that exist, of you want to join.

I do think there's a lot of upside to the "level below" that though (the broad term is intentional community). Rounding people up to build or buy a multifamily unit and establish an HOA/co-op structure would be pretty solid. Or buy a bunch of land and use an HOA or some other legal structure to be "land mates" or something like that. The key is of course finding people who both have the means and a compatible mindset to get something like that to happen.

Yeah, I was thinking more along those lines. I'm imagining an HOA that forbids having a lawn and establishes a communal tool library.

yes exactly, check out ic.org for more resources (maybe find an existing IC in your area too idk)

that is extremely bizarre to put in an offer because the monetary value of that is zero

maybe negative even

children are a burden

IRONIC ANTI NATALIST GANG