https://finance.yahoo.com/news/amazon-hires-ai-startup-adepts-212217362.html

Yes, let AI handle stock trading, this is a great idea and definitely doesn't have potential to collapse the global economy

Unrelated emoji:

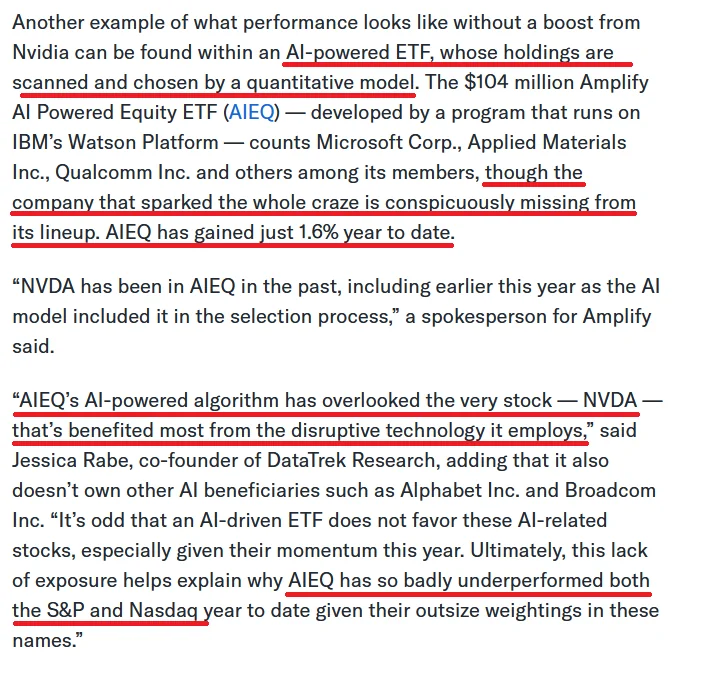

Isn’t most trading done via machine these days? I think these guys just ignored proven technology and used some ChatGPT api to “power” their ETF lol

it says it's using a quantitative model like all the other trading bots, not chatgpt. people were using machine learning models for trading long before gpt 4 but since the "AI" boom now everything has to be labelled AI or AI-powered.

I remember helping a friend wrote one in R and Python like 10+ years ago when we were in highschool to predict the MISO energy market.

Some dude paid us like $3000 to make one for him because he wanted to buy a $10k solar farm in Oklahoma so he could speculate on grid futures...

it's having an outsized effect, i think. might be interesting if the machine learning algorithm is picking up that it's overvalued or whatever else and that's why it's excluded.

I wonder if it's just 'cus Nvidia isn't being talked about much. "AI" is the buzzword, the There's Gold in Them Thar Hills of this bubble. Hardware is the picks and shovels, where the real cash is being made. If they're just training this on scrapping text from the web, that's an easy fact to overlook.

So a bit like how thematic ETFs are usually not a good investment, because they follow the hype and jump on the bandwagon at a point in time where prices have already run up?

It's pretty similar, yeah. A lot of casual investing (and even a worrying amount of professional investing) focuses too much on changes in exchange-value while overlooking use-vale. Exchange-value fluctuates with market trends, with how people feel about something and what they are willing to trade to have it. Use-value is sort of like the 'floor' -- it's the material value of something, its practical use.

At the moment, the computer programmes that get called "AI" have an exchange value that almost certainly exceeds their actual use-value (which is still hazy at the moment; this stuff is pretty new). A hardware company like NVIDIA really benefits from this, because it drives up the exchange value of their computer chips, which already have an established use-value. There's a risk here, though. At the moment, demand for chips is high and they are producing as much as they can to meet it. If it eventually turns out the use for "AI" is significantly less than its exchange value, they'll find themselves producing more chips than people actually need.

In recent times? Probably to some degree, but not completely.

But I would argue that with stocks it isnt unusual for a small percentage to be the majority driver of gains. Even in smaller funds like the nasdaq100. This certainly holds true over the larger market see e.g. here.

I am sure there was a time where your sentence would have been equally true if you replace Nvidia with Tesla, Apple, Microsoft, Google and so on. At any one time it might depend on only one or a few companies, but those stocks will change and aren't set in stone forever.