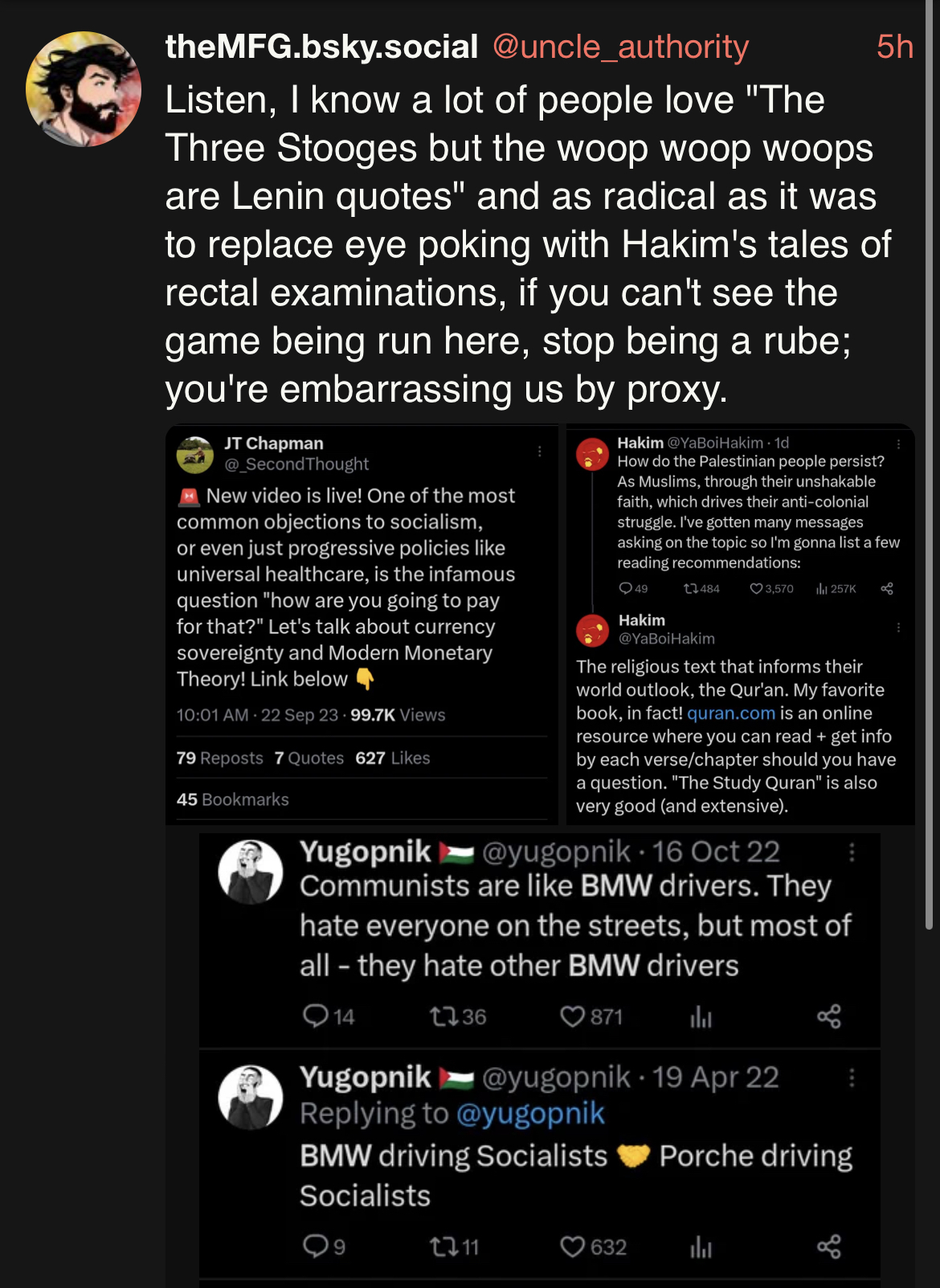

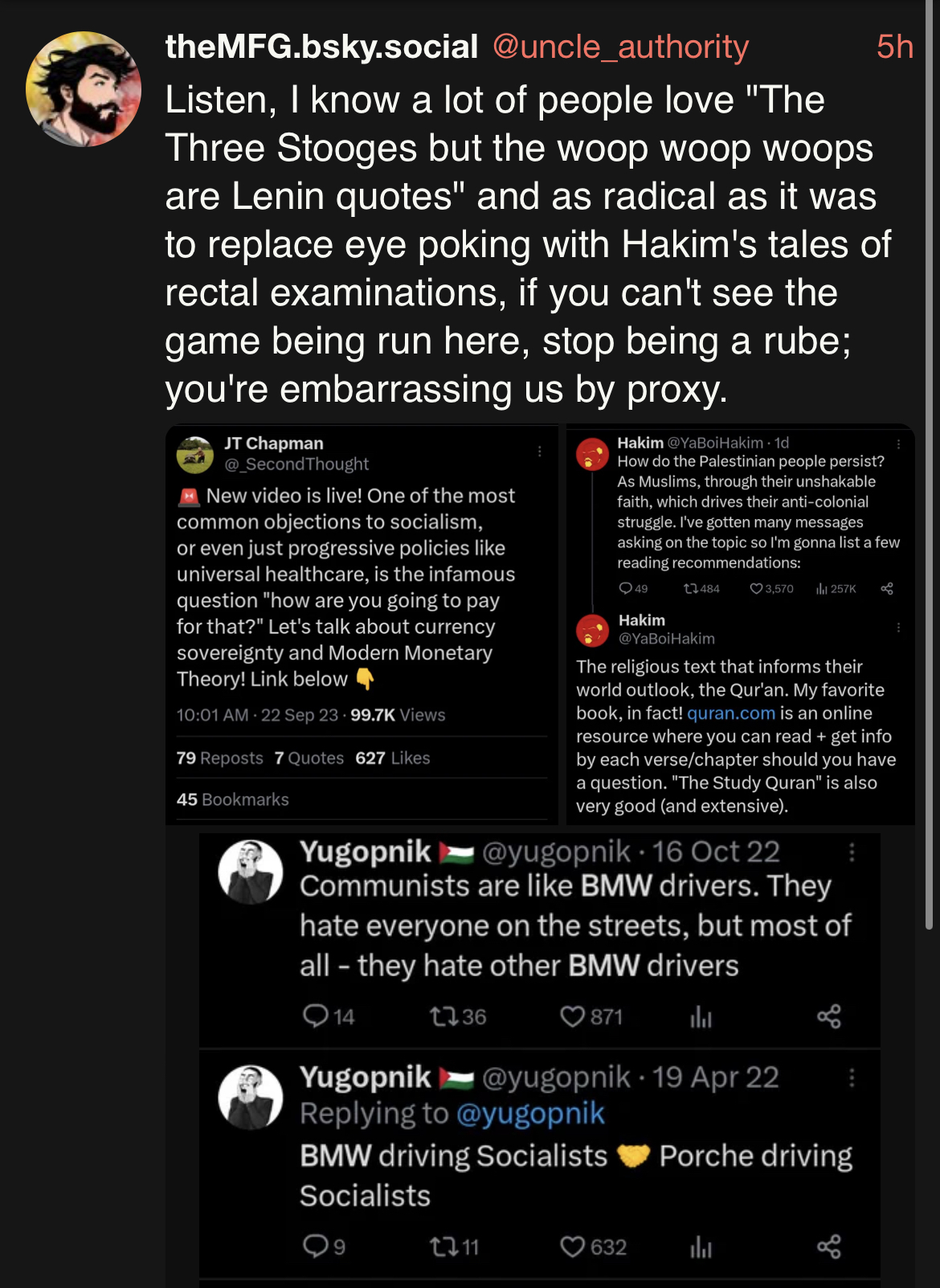

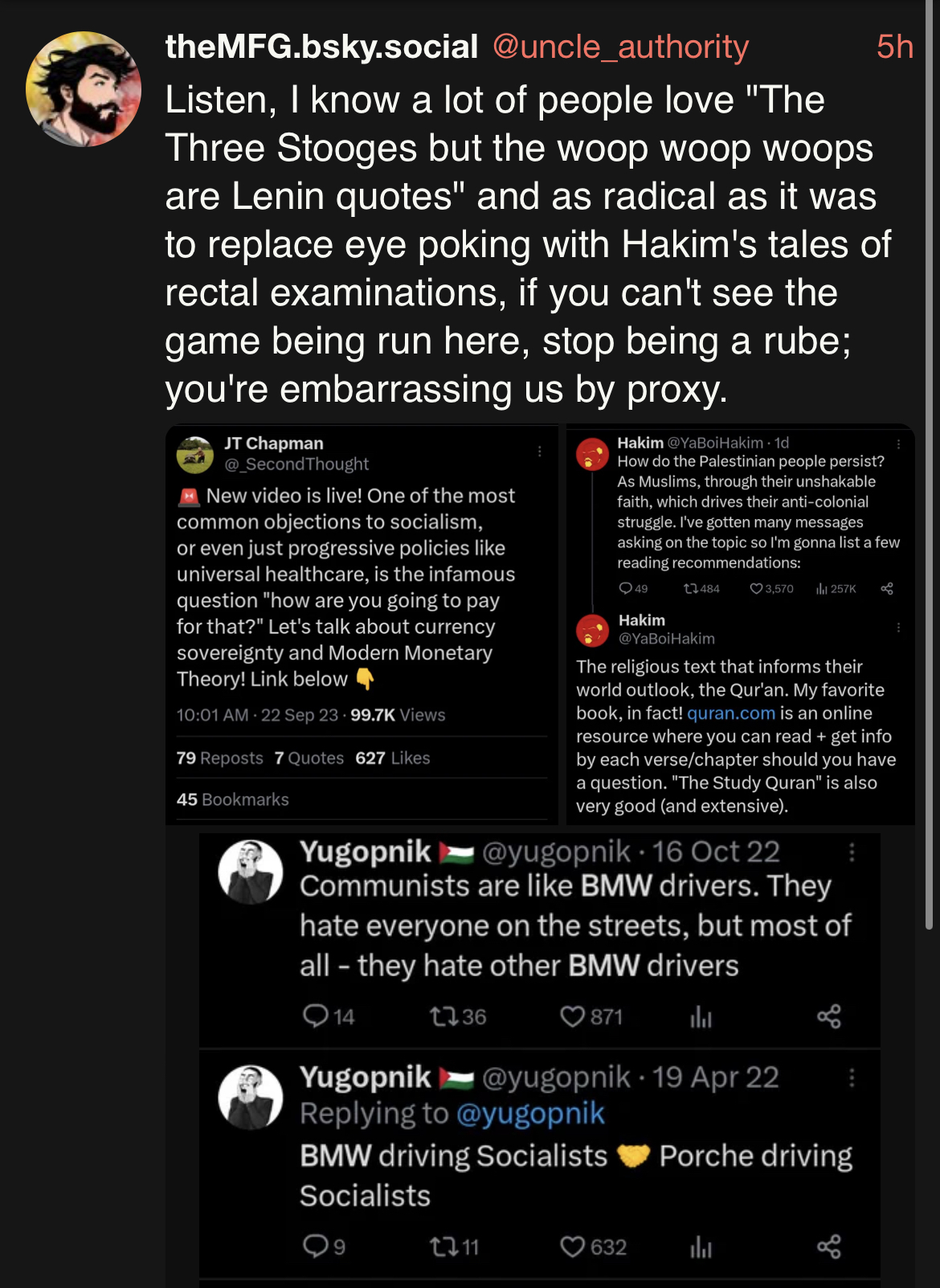

Dude’s an ultra

Bonus: https://nitter.net/uncle_authority/status/1721967810241335347#m

I guess the Deprogram guys are the Three Stooges now? But the joke doesn’t really work

Show

Dude’s an ultra

Bonus: https://nitter.net/uncle_authority/status/1721967810241335347#m

I guess the Deprogram guys are the Three Stooges now? But the joke doesn’t really work

This is wrong. The dollar hegemony has very little to do with the US government’s ability to print as much money as needed to finance public projects domestically like giving free healthcare to everyone.

In fact, any government with monetary sovereignty (currency not pegged to gold or other currency) is not limited in its ability to spend by the taxes it collects. The false narrative that a government cannot spend beyond its means (“you need to tax before you can spend”) came from the neoclassical economics (monetarist) and a faulty understanding of how fiat currency works.

The problem with most developing countries is their dollar-denominated debt (IMF imposing austerity demands) and how commodities they need to import (fuel, food etc.) are priced in dollars, thus effectively restricting their ability to deficit spend as freely as they could.

Dollar hegemony simply allows the US to get “free lunches” all over the world through finance imperialism, because the dollar is a global reserve currency, and everyone wants to earn dollar (to service their dollar-denominated debt, to import essential commodities priced in dollar, etc), so long as they sell their goods and services in dollar, the US would be able to “print” the dollar out of thin air to purchase them - effectively getting “free lunches”.

Here, the US treasury bonds simply serve as a vehicle to absorb the excess dollars spent overseas. This has nothing to do with how the US government as a currency issuer can deficit spend domestically. Even if the dollar hegemony has collapsed, as long as the US has labor, resources, industry and technology, it can always create the amount of money required to finance public infrastructure projects.

The problem with the US is the financialization of its economy giving way to de-industrialization, the austerity measures (government not spending beyond its means) forcing private businesses and citizens to take on loans from private banks, and the excessive burden of private debt (NOT the “scary” public/government debt) leaving its people with little to no savings to spend because those income has been used to service their debt (mortgage, credit card, etc.) and to pay their rent. All these money goes to the private banking institutions and landlords, thus the real sector of the economy suffers.

Read Michael Hudson’s Super Imperialism and the more recent Destiny of Civilization for a more detailed understanding of this. MMT has little to do with the problem you’re describing.

This exactly. This is all stuff for which the groundwork is laid out in Plan for the Establishment of a National Bank by David Ricardo, correcting flaws that he had found in his economic experience trying to follow the gameplan laid out in The Wealth of Nations. This is all classical economics stuff that the machine of industrial capitalism was literally built on and then further explicated by Marx.

The very reason that you can print infinite money and not harm the quality of life of the people via inflation is through economic hegemony

Could you please elaborate? Kaplya is posting huge ass posts explaining their position and you’re hitting back with 1 sentence that amounts to “nuh uh”

Is there a reason that you cant have currency sovereignty without imperialism?

Can you elaborate? This is literally what the Milton Friedman type neoliberals would say.

To reiterate: losing the dollar hegemony simply means the US imperialists can no longer get “free lunches” from the Global South. It has nothing to do with how the US government decide to deficit spend at home, for example, giving free healthcare to people - so long as it is within the limits of available labor, resource and technology.

In fact, losing the dollar hegemony means American capitalists will now be forced to invest at home and re-industrialize, whereas maintaining the dollar hegemony allows American capitalists to move capital overseas, leading to the decline of labor wages at home, forcing people to take on private debt, and thus funneling the wealth from the majority of the population (through rent, mortgage, loan) to the Wall Street finance capitalists (landlords, bankers, insurance companies etc.).