I am

In 2008, America was OK letting homeowners lose everything because it was portrayed as poor people who overextended themselves in home loans with virtually no money down or balloon payments. But now, you've got so many middle class strivers, petite bourgeoisie, airbnb leeches, and investment firms pot committed to sky high real estate prices... I think the government will bail them out this time around to prop up their investments. Good times.

Way to go and ruin my lathe. Housing market crashes but the government bails out Black Rock and housing prices become even higher.

Do they have the money to do that? I thought during covid all the news outlets were saying the govt was running out of places to pull money from, and taxes didn't generate as much revenue this year.

:brrrrrrrrrrrr:

But really. The Federal Reserve can print as much money as it wants. There just happens to be economic consequences for doing so. Printing so much money will cause more inflation but if its preventing an economic collapse its worth it. The inflation might even be negated based on the crisis at hand and who is given the fresh money.

One way of looking at it is to view all federal spending as coming fresh off the printer and all taxes as going directly into an incinerator. You just have to be careful about how much money you are putting in or taking out of the system.

And they've already been saying things like "Obama went too small, we need to err on the side of too big" which, i mean their definition of big

:doubt:

The housing market is generally stable, the 2008 crash was a Black Swan even no one saw coming that required a seriously catastrophic level of systemic dysfunction and corruption, this crypto speculative craze is largely going to just wipe out the most desperate and precarious strata of the working/downward-mobile lower middle class. If you have a mortgage and are financially stable crypto is probably just one small part of a larger portfolio, a gambling game you play to get extra cash on day trading. If you're downwardly-mobile and desperate, you've probably bet your remaining savings on crypto and are now holding the hot potato. You getting wiped out probably won't wipe out the housing market. The housing market is extremely hot right now and the rapidly-rising interest rates are going to cool it very fast, but are unlikely to crash anything. IMO the worst that will happen is the lowest-hanging fruit get caught by the high tide of the flood but for the most part the affluent escape unscathed. The problem is market conditions as a whole. They are downward-trending and are likely to get worst, but I think the recession will be relatively brief.

Your focusing on the retail investment side of crypto which isn't all of crypto. Of course retail investors getting shafted won't crash the economy.

There were a lot of major investment firms more than dabbling in crypto. How many of those are that are still invested in crypto and how much more of the economy are they are invested is something we can only speculate and pray on.

More likely though that bitcoin will just slump like it has before, libertarians will hold on and maybe buy more until it spikes again and we keep having to deal with this shit while the world burns.

Also, the current woes of cryptoland could simply be an indicator that there is an impending liquidity crisis in the "real" market and institutional investors are dumping their funny money to secure their foothold in the real economy.

We will have to keep dealing with this shit regardless, but the sooner it gets laid bare that crypto is not a panacea, the better. Crypto is the embodiment of everything that is wrong about finance, but run by algorithms without even the prospect of state intervention. Just smart contracts running on autopilot like a dumpster filled with diapers and thermite.

I'm latheing that there's more than sub-prime-mortgage-esque scheme running around in the economy and that crypto collapsing will shake it out into the open. If anything crypto and bots have made such schemes easier to make, hide and scale.

exactly i cant even (and have never been able to) afford a car. so like really, buying crypto was one of the only things that gave me any amount of dopamine. (im mostly speaking from how i felt over 2 years ago when i didnt give a shit much about politics or anything like that, i dont really get that feeling now) i really wish people would stop shitting on "crypto" as a concept/some vague thing to make fun of and stick to shitting on the assholes buying embarrassing nfts and the cryptobros who make it their whole personality and are like husks of a human being. and im aware this is anecdotal.but ive only known a few people who have purchased crypto at any point and for any reason. and not one of them were ever making more than like 25k a year (if anywhere close to that even). so in other words they were all poor.

It's valid to shit on crypto at large from a leftist perspective because profiting from speculation is some bullshit. Go ahead and make money of course, but crypto is not a good thing to promote

i agree in general with that sentiment, if the intention for "promoting" is just purely for personally beneficial (financial) reasons. thats big time scum shit. i want to be clear that im not trying to imply its immune from criticism (ive ended up having to sell well over a majority of it whenever i really was like 0 dollars in my chime account broke, over that stretch of those 2 years) just that i dont think its a very nice thing for anyone here or anywhere else online to be almost reveling in it since the big "players" involved are going to be the ones that are hit with the least amount of hurt by anything that may happen (as per usual)....

most hurt will be people like me or those people i mentioned that i knew, that maybe bought very modest amounts of bitcoin or whatever who work some shitty job at a fast food chain, and just wanted to feel like they owned something for once in their lives even if it wasnt for very long at all

crypto is like a cartoon villain's big device: a machine that ruins the environment and prints money*

*speculative assets

Is not the housing market running on unlimited free money being printed and given directly to large companies that are buying up the housing stock?

Michael Hudson begs to differ and lot of speculation with fed dollars going onto private equity funds, that being said the economy as a whole is pretty intertwined, who knows what could cause it to shit the bed, :shrug-outta-hecks:

Love to live in a system that is completely random except for the fact that it will collapse every decade or so. Very efficient.

I would find it extremely funny if the housing market crashed because of apes and slurp juice so yes, I'm rooting for it.

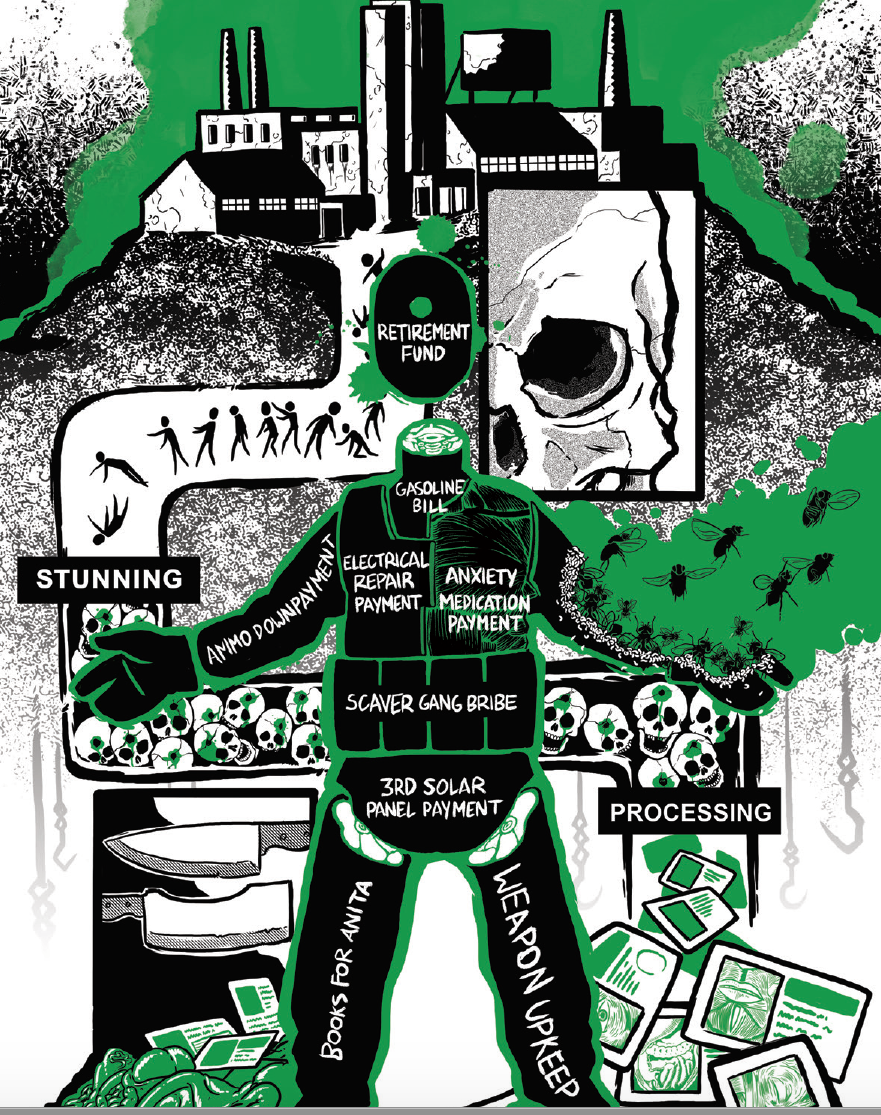

I'm in the middle of the mortgage process so do it either before i close or like, not for a while pls

Hoping it comes after I close because my appraisal just came in above my offer and well above asking price

A real estate crash is unlikely in the United States, not without significant legislation requiring occupancy or the widespread abolition of new development of single family homes or something similarly too extreme for yanks. Some speculative bubbles are more resilient than others.

I will gladly eat my words, but there are too many cash buyers from California for prices to collapse.

God I hope so. I had a 4-5 month period between getting a raise and interest rates shooting up and every place I liked got an all cash offer. I’m doing well all things considered and it still feels hopeless right now. I just want a place to build a workshop that can help me give some meaning to life.

If even I’m doomed to living in a pod to only consume from a video box, I can’t help by put mourn for everyone else.

Is it so much to ask to live somewhere with trees and not on a highway?

Similar here, but for a short period, the jump from the condo to a ~1200sqft townhome was about an extra 125k more. They just went so fast and were extremely over bid on.

I'm just bouncing around the stock market subreddits posting Lenin quotes until the bottom falls out.

Interest rates are gonna help more than crypto I think. Unfortunately the people who will get hurt are the overleveraged owner occupiers not the investors.

no not yet I need some time to save up how about an apocalyptic housing market crash in 2 years

The housing crash in 2007 didn't make housing more affordable. All the defaulted mortgages meant banks owned more houses to be held empty and rents shot up. Another housing crash will only increase rents as a lit more people are thrust into rental markets in into tent cities. The only solution is social housing but governments are just instead giving incentives for developers to build luxury flats that will remain empty.