After Congress passed $52 billion CHIPS subsidy:

-Micron, which had said it would invest $40b in the U.S. this decade, announced it will cut capital spending

-Intel cut its capital spending plans by $4b, but predicts a “growing dividend” for shareholders

The stresses have also been felt throughout Asia. Late last week, the chief executive of Chinese chipmaker Semiconductor Manufacturing International Corporation said demand had slowed from smartphone and other consumer electronics makers, with some stopping orders altogether.

the change in sales is global. But that might not impact investment into the semiconductor industry since that is quite important

Yeah I expect them to focus more on R&D. I mentioning sales since they'll have less revenue to but in R&D, even if they manage it wisely

:FrogPog: mom can you give me a couple billion $?

:lady-doge: to innovate and improve production?

:FrogPog: yeees

actually gives money to shareholders like a boss

Actually, China did some neoliberal brainworms in the past ten years in the chips industry, where they have mostly relied on encouraging private capital and entrepreneurship to boast research and production (still with state investment of course). Some of them have been quite successful, such as those involved in the electric car industry. But a good number of them seem pretty similar to those Silicon Valley startups that mostly just scam investments and government subsidies—and there have in fact been a few prominent cases of private-equity-backed startups going bust just months after launch. And the whole industry seems to have been plagued by financial speculations as well (of course private investments tend to be more interested in short-term returns than long-term national strategic goals)

Fortunately, literally just over the past few weeks, the government has been rounding up some of the biggest players in the industry (managers of investment funds, CEOs of major companies, etc) for possible corruption etc. Hopefully the state has realized that it needs to play the leading role.

Fuck neoliberal brainworms everywhere lol

Lol.

Greed is crazyEurope is poor. China isn't going to capitulate to American corps like the usa thought

American corps are destroying their own future to juice numbers today. Their is no other markets out side of the usa for usa corps.

Pretty interesting to just watch greed destroy the seekers of it.

Having a stable party structure like the USSR and PRC do seems like an enormous strategic advantage. They can actually make plans and carry them out over the course of decades while the US lurches from one profit-chasing scheme to another amid constant, wild changes in government policy.

Naw man. Clearly handing out govt funds to private corps that than use it to pay their investors is by far the smartest model out there

Indeed. But there was no market for European goods in Asia in the 17th and 18th century. But then colonialism happened.

The US military, certain agencies and the World Bank/IMF are going to be very busy next few years, creating markets for US goods.

Quit living in the past

This is a huge problem with the left. People still think it's the 70s.

China is there. They are everywhere building actual good will. Usa has raped and pillaged the world to make markets in the usa and Europe. Europe is fucked.

What market are they going to open? India? To sell what Indian made goods back to India?

It's not living in the past. It's looking at the past to learn the Imperialist modus operandi.

We know China will out produce the west and that's the reason for the desperate attempts at slowing China down. They tried to isolate China with the whole Xinjiang issue but it didn't work. Now it's provocations over Taiwan to start a war and try to break any China-global south cooperation through sanctions and bog down China in wars. If Taiwan is merged with the PRC, the next conflict will be in Korea. If that doesn't work, then South Asia and so on. There is a huge goodwill for China in Pakistan among the people and it did not stop essentially a coup this year. If needed, there will be a lot of coups to remove Pro China governments around the rest of the global South.

I am not sure what point you are trying to make with regards to India. They have already successfully "opened" up India since the 90s and Modi and Co. will happily privatize whatever remains and will be used as a cudgel against China if needed.

As long as the influence of the the aforementioned US groups remains, we are not going to see lasting peace.

We are living in a dying empire that is my point. My point is all the markets have been exploited. You seem to be talking more about imperial political power. I'm strictly talking goods and capitalist based markets. We are in the death spiral of squeezed labor.

There is nothing left to exploit . The powers aligning with the usa right now are either going down with the ship or will bail. Momentum is on chinas side.

I think people really think this is going to take decades and decades to unwind. Nothing moves that slow anymore. Each year and each election America will unwind more and more till something in the core snaps.

We have not even begun to see the toll COVID is going to have. Huge swaths of the labor force is sidelined.

They have already successfully “opened” up India since the 90s

where can I read more about this

I don't have any book since my source is living through it and studying it as a teenager. But in the late 1980s with the collapse of the Eastern bloc and Soviet union as the trading partner and a source of aid, the Indian economy was in shambles and as a condition for aid/bailout, the IMF forced India to remove a lot of import restrictions, economic "liberalization" in the form of privatizations as well as reduction in regulations. Look up economic liberalization in India in the early 90s.

But in the late 1980s with the collapse of the Eastern bloc and Soviet union as the trading partner and a source of aid, the Indian economy was in shambles and as a condition for aid/bailout, the IMF forced India to remove a lot of import restrictions

why didn't something similar happen to China?

Because China was much less reliant on the USSR by the late 1980s having had a decade of foreign investment as well as the Sino-Soviet split which meant that trade between them was much less.

Another factor worth noting is the difference in the Indian and Chinese governments from 1950 to the early 1980s. Even though GDP wise, India and China were in a similar situation in the early 80s, structurally China was far ahead, with much higher literacy, better healthcare, less infant mortality due to the CPC being a lot more effective at making structural changes and improvements and spending a lot lot more on improving these indices. This meant that when the markets were opened in China, they had a much larger educated labour force capable of taking advantage.

On top of that Mao had eliminated the landlord class, while in India, the landlords as well as the oligarchic families continued to hold power. A huge number of Indian politicians dominating Indian politics today are dynasts and scions of wealthy families in the past.

This isn't Intel & Micron doing this in spite of the CHIPS act, this is the intended result of the CHIPS act.

it's literally exactly what Bernie said would happen, and I saw libs calling him "reactionary" for it

:michael-laugh: libs and using words they don't understand. Classic

This is literally just giving billions of dollars to rich people lol

Honestly I kinda prefer capitalism at this point

Because I honestly cannot see a socialist movement ever happening in the US that doesn't eventually boil down to or get hijacked by some variant of "national socialism"

And it wouldn't suffer the same consequences as Germany because the US still basically owns the largest military, nukes, 10x the amount of land, etc. As long as it didn't become stupid enough to start invading Mexico or China (which I guess is doubtful)

at least with capitalism it will obliterate itself eventually

Yeah, finding it really hard to argue against the third worldist position. Not that I’ll give up trying to organize but that’s just for survival.

Out of all the chip makers I think Intel is in the worst situation Their servers CPUs are losing marketshare and the graphics division they've been building up for years keeps delaying their product launches.

Their shareholders are stupidly demanding that they get their dividends. And since Intel stock has gone down so much recently they're caving in to that demand. At the expense of their own future

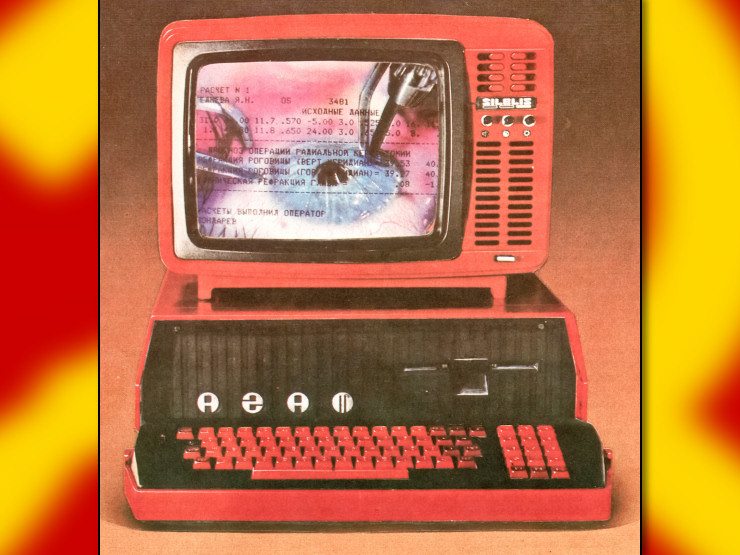

TSMC (in Taiwan) makes the best chips for Apple, AMD, sometimes Nvidia. Samsung also makes a lot of chips but they are behind TSMC.

That's one reason the US passed the chips act. If anything happens in Taiwan, like China taking it back or just like an earthquake, it would massively interrupt things

Said it elsewhere, but

Companies, particularly large ones, will always use unexpected excess cash for share repurchases or dividend payouts for several reasons:

-

Executives are increasingly compensated in short and long term incentives (read: they’re rewarded for the company performing well and with stock options)

-

Almost every large company does buybacks, something like 94% of the companies on the S&P 500 had done a share buyback in the preceding year as of like 2017, because

-

Share buybacks help inflate performance metrics, which is essential since most of your competition is doing them (and since executives are rewarded on the basis of ‘company performance’…)

Gotta hand it to good old saint Regan sticking a fucking investment banker in charge of the SEC, because that’s how these became legal; prior to that, they were EXTREMELY regulated and basically impossible to do.

Firms which are already listed on stock exchanges and are sizeable (or at least comparable to their competitors), will generally use unexpected cash for more shortsighted purposes; this is typically partially because of the aforementioned stuff, but also because firms have generally already laid out budgets and ‘planning’ for the next few years.

That cash windfall is not useless, but for a given corporation is not immediately useful; it’s not earning anything, it’s not doing anything, it’s just ‘there’. So many executives see the greatest immediate ROI as the best use of it (unless they have a crises elsewhere), and that typically is (surprise) share buybacks. It could also be used as collateral to take out loans when interest rates and LIBOR were still verrryyy low, the loans then being used to do the buyback (I imagine that is less common currently).

Which just shows how capitalist economics is kind of irreparably broken. Shareholders are rewarded, financial brokers/investment firms will consider it a good use of capital which helps boost the stock, the firm itself benefits from performing the buyback as it will compare more favorably to its peers than if it did not, and it gains back stock it can reissue at a later date (not to mention the executives giving themselves bonuses, essentially). So it is a fantastic short term use of capital.

But of course, nothing tangible is produced, workers gain little to nothing (unless they are one of the very rare firms that also compensate workers via stock options), and consumers will likely not see any benefit themselves.

It could be declared illegal again, but good luck putting that genie back in the bottle when damn near every firm on the NYSE does share buybacks

-

The sun is about to super nova but the dems say "now is not the time" to raise the minimum wage to fifteen neo-neo-neo-neo-neo dollars.

Dems also say everyone must be patient. Eventually everyone will be transported to the Centauri Colony millions of light years away. Every single last soul will get there. Delays happen. This is normal. Many hundreds of years ago all the rich people were evacuated but the meek shall inherit the earth, right?

Argh.

That's exactly what they'd do. You wouldn't simply get a ticket. Oh, no. I entirely forgot "access to"! Haha.