- cross-posted to:

- chat

No you see the thing is, once you actually make products people can figure out your products are shit. If your company is 90% marketing gimmicks, there’s less products for people to hate. Those other companies fucked up by making too many actual cars.

(I’m quoting from capital volume 6, don’t @ me)

Tesla makes products. And the products don't suck (any more than any other lumbering multi-wheeled energy hog).

But the real value in Tesla are all its patents. They're trying to corner the market in future potential lawsuits. This is the true unlimited power of Tesla. Elon Musk is just going to claim he has the patent electrons by the end of all this.

I think I drank different coolaide. Tesla produces a low number of cars, their cost per production are high, their parents are overhyped and thinking the market capitalization of tesla and apple can be explained from the products they produce is a reduced view of stock market valuation.

Besides the German tanks were over engineered and beaten to trash by superior soviet mass produced tanks which fit the job better. Something similar could be said here.

I hear you. But this isn't a military conflict. It's not like the Germans could beat the Soviets by suing.

The benefit Tesla has is in the legal system. Even if they don't produce vehicles themselves, they can license the tech to all the other firms on the list and collect a vig without any overhead. There's also a real expectation of fully automated vehicles in one or two more Friedman Units. Assuming Tesla has a working solution for automotive automation, literally everyone else will need to license that from them.

The cars themselves are glorified tech-demos for the industry at large.

I can speak with inside industry knowledge on this. Tesla is not a leader in vehicle automation. They are not even very competitive. They are very visible to consumer, but they can not compete without the use of optical radar. They have claimed to achieve close result with a camera, but this is not physically possible. Computer vision and camera sensor alone can not deal with road conditions reliably. They refuse to add any form of radar while others do. Their software is also not very advanced and is glorified cruise control.

There’s also a real expectation of fully automated vehicles in one or two more Friedman Units

There's not and anyone who thinks there is has been chugging musk koolaid way too much.

Tesla runs in Koolaid.

All of this valuation is predicated on the promise of future SuperTech that is all owned by Elon.

It's speculation in the rawest form.

You're forgetting their brisk business selling indulgences to non-EV car manufacturers currently.

Ah, the ol' Oracle strategy. You love to see it, folks. I guess they did learn some innovation from the tech sector after all.

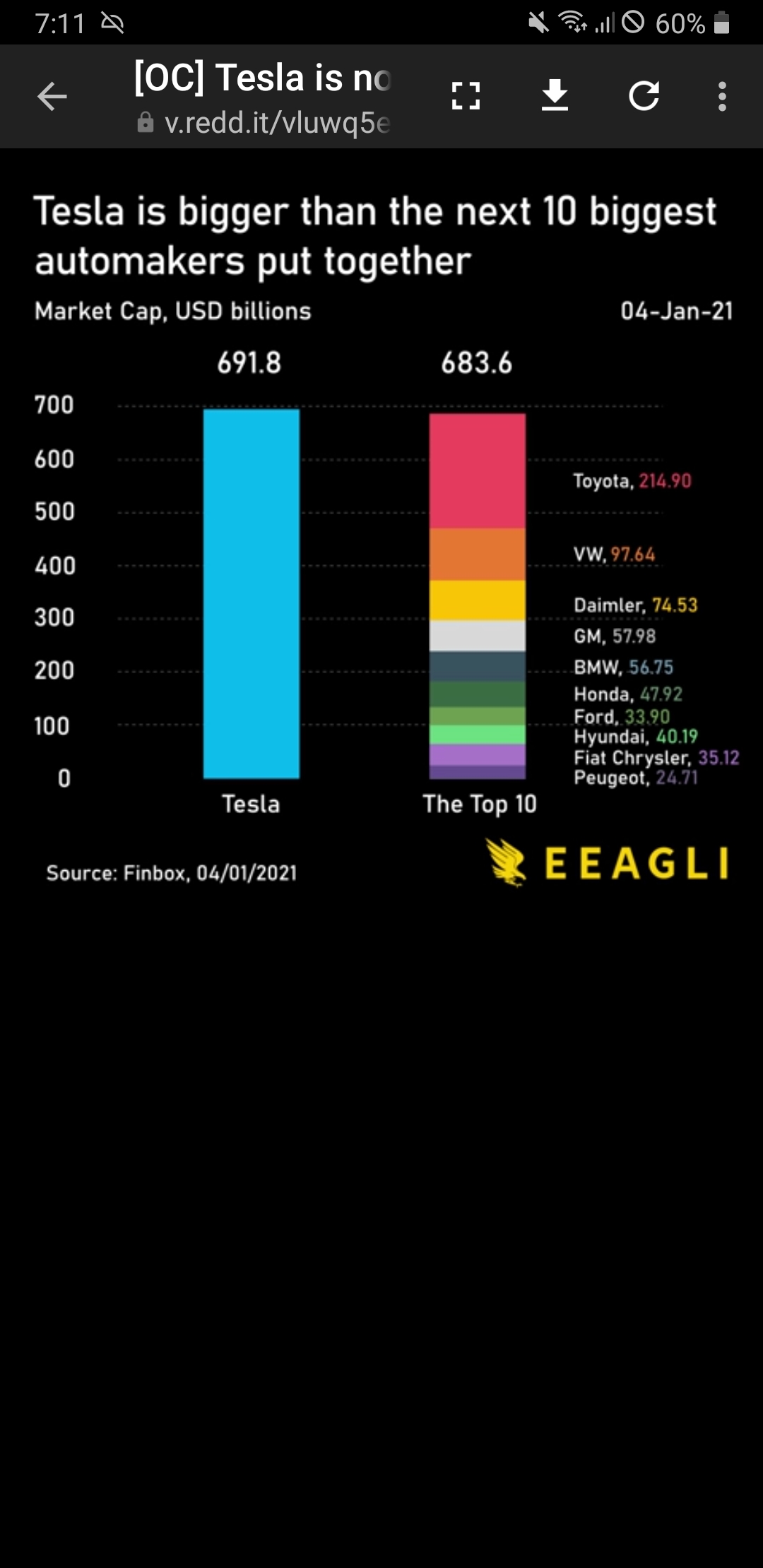

I have seen a tesla three times in my life. How are they bigger than established auto companies? Is this a meme?

this is the Market Capitalization and it's basically a measure of stock price times how much of that stock there is.

basically, Tesla has issued a shitload of stock and people for whatever reason think it's worth something despite this showing that it's obviously wildly inflated.

stock price times how much that stock is trading for.

Unless I'm mistaken, I think the second one should be the amount of outstanding stock

This is the reasoning you'll hear from capitalists and Tesla apologists: different industries have different ratios of their assets to market capitalization, its above 100% because in a healthy business you get more profit and money from them working then you do liquidating their assets.

Manufacturers might have a ratio like 3x their assets. Tech companies are usually valued higher. Tesla is viewed, by capitalist Tech evangelists mind, as a tech company. So therefore its market capitalization ratio to its assets should be much higher. They'll give a bunch of reasons: Tesla focuses on its self driving and software, Tesla isn't an auto manufacturer it's an industrial-scaled 3d printing assembly line, etc.

From a Marxist perspective, tech and finance are "fictitious capital" and tech is getting blown up by irrational actors trying to counter the tendency for the rate of profit to fall. We have been in an extraordinarily low profit rate regime since the 90s (since the neoliberal turn from the 80s to late 90s, previously profit was slumping since the 50s and we've never recovered to those profit rates), and capitalism has become nearly globalized - there are few options for new frontiers to open to imperialism, all that's left is China, Iran, Venezuela, Cuba, so capital has turned to these fictitious sources for profitability.

Capital props up companies like Tesla not because it's in any way rational or sane, but because its searching for profitability.

It's a pyramid scheme at this point, paying out investors by issuing more stock thats bought by people who 'support tesla' or think somehow they're gonna take over the entire market in our lifetime

Hype, points for the "future," points for their CEO, etc. AKA made up

I actually see a lot.

Liquidating the vestiges of European social democracy to the benefit of American speculative finance.

Redditors have too much money and an insatiable appetite for buying Tesla stock

The closest thing to rational explanation of the cost is that they are the closest to figuring the self-driving thing and once they do they're going to rake in profits.

They aren't close to self driving, no one is actually close to self driving.

Uber just dumped all of theirs. Regulators are getting more and more pissed off that Musk won't back off on the self driving rhetoric.

this

also tesla is locking features behind monthy subscriptions, lmao

Looking forward to the day when the police can throw you in jail because you pirated your steering wheel software.

I can see a future where they put some sort of blinking light on the rear of your car to notify the police that you're using unauthorized software on your car.

Or maybe they just automatically send your registry information to authorities when the car detects said software.

Short selling. Unfortunately the more easily accessible trading apps don't allow it as you need a margin account.

This ridiculous overvaluation has gone on for years and may continue for years.

The market can remain irrational longer than you can remain solvent as the saying goes.

According to Marx a stocks value stems from 2 sources:

- The actual assets it represents: Buildings, machines, patents, inventory ... [in this case Tesla has some, but nothing really remarkable].

- The future return of interest that can be expected. I.e. two companies have assets of equal value and both issue 10000 stocks, but company A makes 10% profit on avaredge and company B just 5% than company As stock is more valuable than company Bs stock. [Tesla made a pont that the combustion engine was on the way out and made a somewhat convincing point that only they were really reacting to that and may have somewhat of a monopoly or at the very least a serious headstart when it comes to electric engines/batteries.]

This is the rational part behind Teslas stock price rising, expected future profits are priced in. Of course it is completly blown out of proportion. In parts because markets have seen a tsunami of fresh money since 2008, but actually good investment opportunities are fairly rare compared to the amount of money. It is also a self reinforcing cycle of a rising stock attracting buyers making the stock rise further..., but will in the end correct itself (and may end up with Tesla blowing up or being baught up after a price collapse by Toyota or VW or BMW.

I think their charging infrastructure is important as well, since they may be able to turn that into local monopolies.

I posted this comparison when tesla passed Berkshire Hathaway. It has gained ~150 billion since then.

Tesla (now 6th largest company in the US) vs Berkshire Hathaway (Warren Buffet's holding company #7) Tesla market cap: 555 billion BH market cap: 543 billion Tesla annual revenue: 25 billion BH annual revenue: 330 billion

So is Tesla worth more than a company making 13.5X more revenue every year? What if there's a competitor 2 years from now? What if government policy changes and Tesla can't sell it's green energy credits? Even if everything goes right how can it keep going up? It's nuts.

Literally only like that because Elon Musk is a meme man and rich idiots think that means they should invest in it

Nikola is a market competitor and so far it's basically just Tesla small time investors getting mad that their Musky boy has direct competition in the same EV segment, lol.

This is perfectly logical because capitalism relies on the delusion that you can replace cars/trucks/etc with electric battery power. In reality there is no alternative to gas diesel fuels

In reality there is no alternative to gas diesel fuels

Trains and public transport in general along with decentralized, local production and consumption.

what sucks is that used electric cars suck donkey dick because the batteries are all garbage.