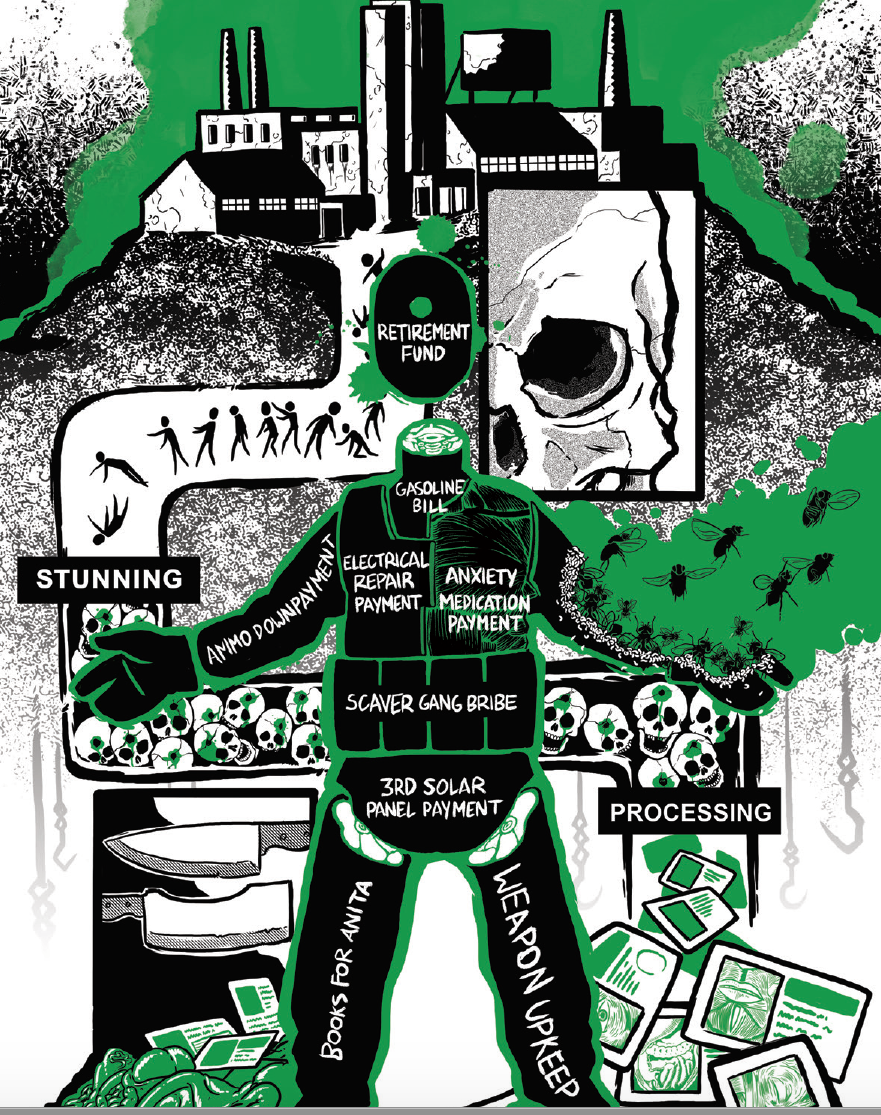

The math inevitably favors acting like the infinite growth model of capitalism has a future, no matter how unlikely our economy is to survive?

Remember that crisis is part of capitalism. It will recover from every near death experience it has as long as there are people who need to work to survive. It will survive the next crisis that we can all feel is right around the corner. And it will also survive the ones after that, including the crises created by global warming. There is no alternative to building socialism. There is no waiting for the death of capitalism - it won't die without the global DOTP.

Stock markets are run by algos nowadays. There is no human behind the vast majority of trades in the market.

Some algos are proactive and competitive like high frequency trading but most of them are reactive like Boomer retirement accounts which autosell/autobuy to balance bond or equities in a portfolio. Both exuberance and doubt in the markets can become quickly magnified as massive pension/retiree accounts shuffle in and out of varying allocations.

Honestly, as someone who works with machine learning and data science, the thought that so much of the economy is run by algorithms fills me with absolute dread.

I've been stuck listening to my crypto chud relatives all weekend, and they tell me Bitcoin is going to make us all rich and solve literally every problem on the planet, but especially global warming and inflation.

Lol magic computer money will make us all billionaires somehow don’t think about it trust me bro, but just simply allocating abundant resources to societal needs is just fuckin utopian Sci fi shit

Yeah back when I was into Bitcoin I used to get downvoted on the Bitcoin subreddit for saying that you can't solve political problems with technology.

if every problem on the planet can be solved by buying drugs with invisible magic computer money then sign me tf up

inflation isn't even a real problem it makes debt less of an issue

Wages are supposed to inflate as well, which people don't account for. Obviously that doesn't always happen which is a real issue, and there are better ways to manage the economy than moving the interest rate/inflation lever back and forth, but it isn't inherently bad, like you said.

Yeah people talk about it like it's something unequivocally bad rather than a nuanced issue

What if someone doesn't have debt? What if inflation just means they're paying 20% more for groceries and 20% more for rent and 50% more for gasoline? What about those who are on a fixed income?

Inflation is a real problem from my perspective, although I'm glad if it leads to student loans being easier to pay off.

It's difficult to pin down exact numbers.

according to Northwestern Mutual’s 2018 Planning & Progress Study, which also reports that “fewer people said they carry ‘no debt’ this year compared to 2017 (23 percent vs. 27 percent).”

( https://www.cnbc.com/2018/08/20/how-much-debt-americans-have-at-every-age.html )

A website called shift processing seems to agree with these numbers, saying:

8 in 10 Americans have some form of consumer debt, and the average debt in America is $38,000 not including mortgage debt

https://shiftprocessing.com/american-debt/

So you definitely have a point that most people have debts

Weird that they don't include mortgage debt. Everyone has it but that doesn't make it not debt

It's bad for some people good for others. Same as a lack of inflation. Inflation helps exports but harms imports.

I've never really understood this line of thought. How can everyone be rich? The whole system necessitates people struggling to get by or else it collapses

According to my brother in law, it's just because banks keep everyone down and control everyone, but it totally isn't capitalisms fault.

When the stockmarket is high, it's actually bad. It's more expensive to buy stocks and the odds that it will keep going up indefinitely is lower with every new high. Even if you're rich, it's a bad investing environment. Meme stocks are bad for investors too because the fundamentals are wonky and volatility caused by retail traders can be fickle. Crypto is too volatile for any long term store or value or gain. There's no good investments outside of real estate and that's being quickly swallowed up to the point where it's prohibitively expensive too.

Massive sell-offs will drop prices while buyers will push it up again. Sellers won't sell as long as they think they can afford to hold and sell for a higher price in the future. Buyers will buy because as long as they think they can afford to buy on margin and sell it later for a higher price. All this requires a belief that prices will go up but also that someone out there is giving away the loans to support this shit. That's where QE and the Fed comes in. As long as they keep propping up investment, the cycle continues and investors scramble to find value in anything.

We're going to see more absurd speculative instruments in the coming years. They're already doing Enron for water and something to do with ETFs whose value is based on not-fracking and shit. Crypto and NFTs are just the start.

It's probably not accurate but I've always had the morbid thought of the stock market continuing along on some super computer somewhere long after humanity has gone extinct.

Those break down fast without workers. Like insanely fast.

Think about how often people have issues with their computers, now multiply that by a million.

You would maybe have 6 months tops beyond infrastructure no longer being maintained. The systems inside of a computer, and the systems in the world around a computer that are necessary for it to function fail real quick without human interference. Computers on their own crash on average every 3 months or so.

Funny, I've always had the thought of the stock market continuing along on some super computer somewhere long after humanity has switched to full communism.

I think we're heading off the cliff, but that belief mostly stems from observing public sentiment. It's become increasingly obvious that even average Americans are starting to lose faith in our markets, and that's usually when bad things happen. I'm not an economist so 🤷

The idea that the stock market is anything else but an algorithm that maximizes a certain value, and that it has anything to do with the real economy is pure and absolute fantasy. Especially in the days when so much of it is driven by other algorithms trading with each other and massive hedge funds being able to direct things ...

Signs that the stock market is failing would be things like high volatility, low confidence, and capital flight to more stable markets. If no stable markets exist, you'd probably see a consolidation of companies into mega monopolies.