https://www.cnn.com/2024/08/04/business/japan-nikkei-stock-rout-intl-hnk/index.html

CNN writes paragraphs about Japan's stock market collapsing, Amazon and Intel underperforming, then blames it on Hamas lmao

please khamas reprise this october but instead of a concert do the stock market

Pretty much every econ nerd I know is saying this really isn't that big of a deal.

There's been like 10 different "impending economic collapses" since 2008, r/econ has a freak out over this like every 6 months. So far, nothing has ever happened. Maybe it's different this time but I'm not losing any sleep yet.

There's been like 10 different "impending economic collapses" since 2008

It's not like there weren't plenty of opportunities, most recently when COVID got started and the feds had to give enormous amounts of free money away to keep the

from imploding or the recent bank collapses

from imploding or the recent bank collapsesIdk, maybe it amounts to nothing or is averted somehow, we see but it's not nothing either, an enormous amount of fictitious capital just got wiped

And the US still has dollar hegemony so more fictitious capital can me made.

Nothing ever happens.

Economy was already very shaky before COVID hit, seemed like the market was teetering when it was rapidly jumping +/-2% day to day when COVID finally took control of the narrative that everything was blamable on it. COVID made me pretty conspiratorial about that, it was a really convenient shock to allow the economy tumble and for the government to fully subsidize it.

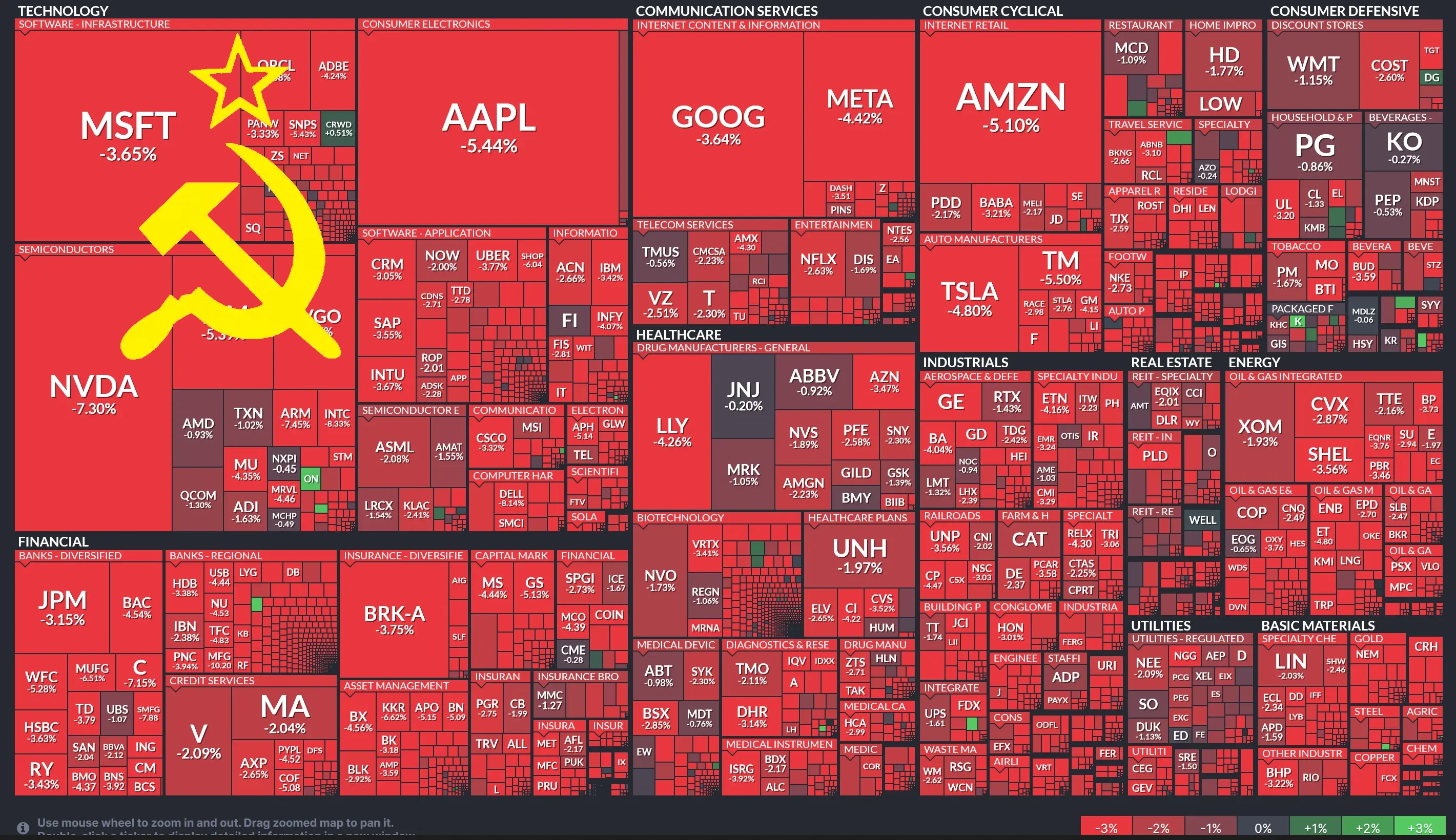

seems it's mostly a response to the intel layoffs, high interest rates keeping debt expensive, a burgeoning bourgeois realization that the ai hype is vaporware obfuscating elaborate mechanical turks and that tech sanctions against china are counterproductive

Large institutional capital firms have been liquidating their stocks for the past week and making noises about recession. The market is freaking out as a result.

It's probably nothing in the grand scheme of things, but could signal that a major economic downturn is on the horizon.

Long term investors offloading the bag under the pretext of "weak US jobs numbers" and general interest rate stuff.

I think this might be the beginning of it. A bunch of tech companies released some pretty dismal financials, which (along with continued high interest rates) is freaking everyone out.

Add that people don't like ai, there's not a business case for it yet, and it's very expensive to run/train

Love to burn 1000 hectares of the Amazon to generate a picture of Trump with huge gazongas

Honestly this is a better use of resources than most AI related projects

It wasnt just tech either though, both McDonalds and Starbucks are doing worse than expected, and a lot of economist/stock people look to those companies as indicators for how the poors and bougie poors are doing with spending.

Amazing that you can't just jack up prices of commodities without raising wages forever and not have line go up more and more steeply each quarter. Nobody could have predicted that.

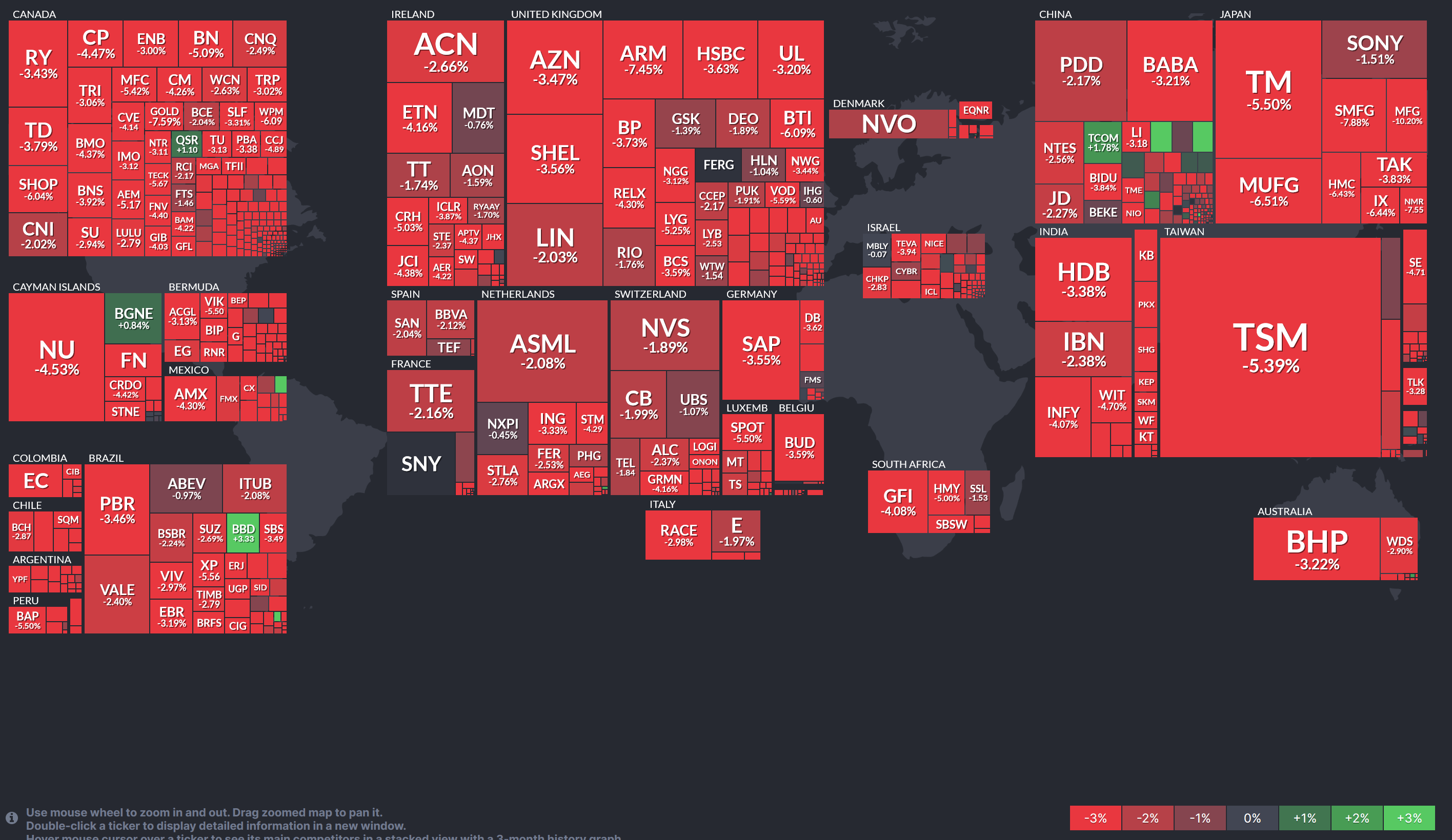

Markets have been getting more volatile for weeks, making these days more frequent. Japan's stock market fell 12.4% today. This is partly because the yen strengthened 10% in the last month, which means Americans will not want to buy treats from Japan because they are more expensive. They also thought Jpow would let us have low interest rates again and he did not, so they also think we will not buy Japanese treats because we won't have jobs. The Japanese stock market is the 3rd largest in the world. Big losses on a big market will spread because everything else will get sold to buy the Japanese dip. It's also going to cause monetary contraction because of levered speculation. Large amounts of money is called into existence to buy stocks and that fuels demand in the real economy, and when those stocks go down, the loss in equity is large, stocks are sold at a loss to repay the borrowing, contracting the money supply and lowering buying power and demand across the whole market. But one never knows when it will stop.

I don't understand. I see this and I don't understand it. Capitalism is made not to be understood, it hides behind shit like this that the average people like me can't comprehend

what the fuck does it mean 2 trillion dollars were wiped out? Did someone just stole it and stashed the money in a vault in fucking rural Virginia or something?

This is literally clownworld, capitalism is so fucking fake it's mounted on feelings and graphs jesus christ let's tear this fucking shit down.

A hypothetical: a group of stonks are valued at $3T based on the number of stonks in circulation and the values they are being traded for. Due to whatever factors, the values those stonks are being traded for declines by 2/3, meaning the same number of stonks are now valued at only $1T. $2T of value is gone, but no actual real money is destroyed.

If youre still confused though; the issue is that while those values of stocks are being traded at $3T real more solid financial decisions are being made at that valuation. If youre one of those investors and you have $100,000 or something in those stocks you could use them or they would be evaluated in collateral in loans. Thus the fakest parts of the economy become realized in your pocketbook. If enough investors get loans or have other financial instruments get destroyed by this loss of valuation it leads to the banks being unable to shore up their own losses. then you have people losing their banking abilities.

It always trickles down to those who make up the realest parts of economy, the workers to dig all these financial sickos out of their holes.

It was I who wiped 2 trillion dollars, I wiped them off my bum with toilet paper

Saying that companies are "worth" their market cap is a lie the news tells because it's simple and makes good narratives. The truth is both much more complicated (share prices allow companies to more effectively borrow money and pay high level employees) and much simpler (investors are dumb panicky animals and will cause chaos in response).

JPOW rose interest rates to cause layoffs, the only way to help the economy is to destroy people with it.